Most B2B vendors are well aware that offering multiple financing options to their customers is crucial to sales and customer retention.

To their credit, vendors typically do offer more than one way for their customers to finance large and small purchases alike. As a recent Credit Key survey found, most suppliers offer 30, 60, or 90-day net terms — with many also offering larger loans (i.e., for equipment) in the range of 12-36 months.

See the problem?

(Hint: What’s 360-90?)

The Financing Gap Problem

Hopefully, you were able to solve the math problem above to arrive at 270.

(And hopefully, you see where we’re going with this.)

Yes, offering 90-day net terms along with 12-36 month terms allows you to cater to two very different audiences, each in very different financial situations.

But there’s a 270-day gap in between these two options.

And, before you ask:

Yes, your customers want you to fill it.

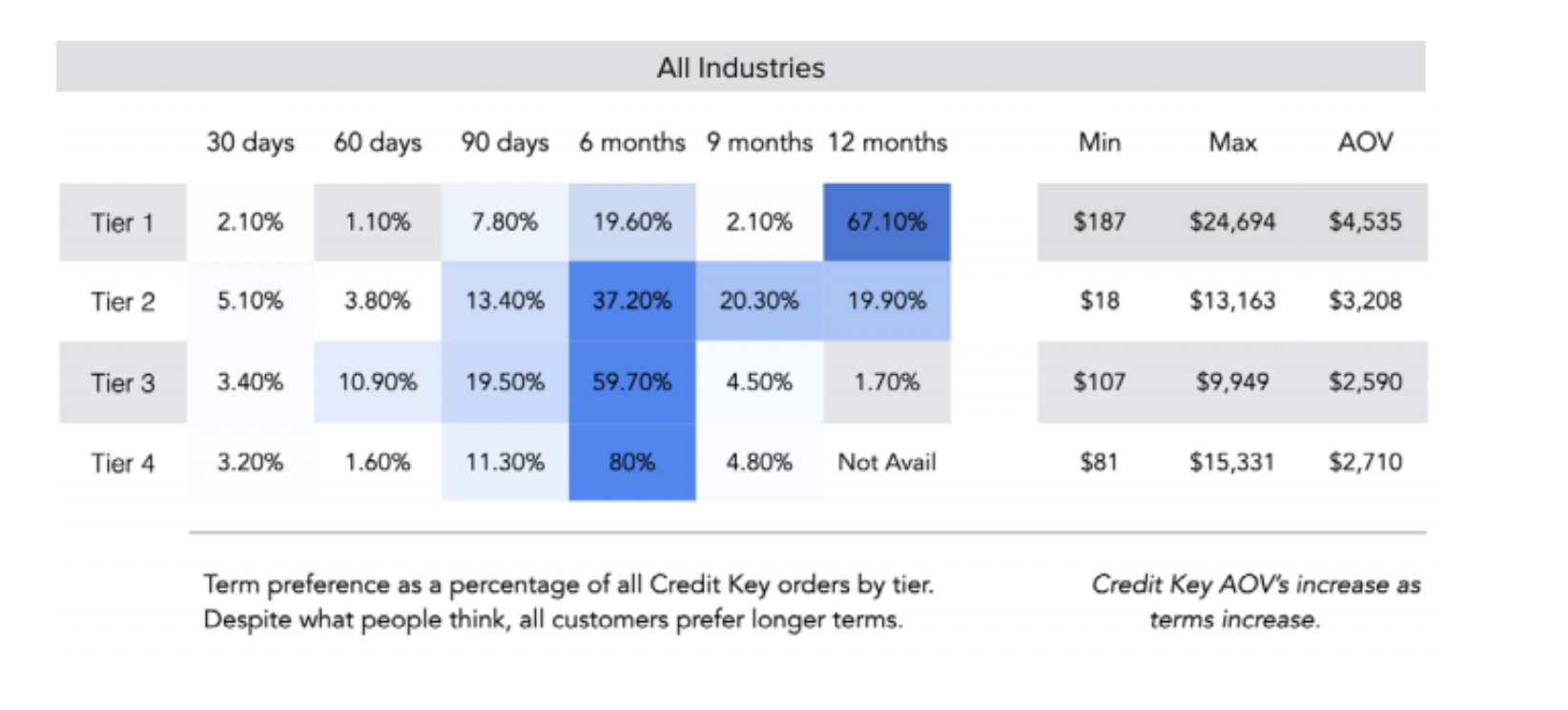

In fact, 80% of today’s B2B buyers look for terms that extend beyond 90 days without requiring a long-term, multi-year commitment.

In the years to come, this financing gap will prove to be a major battleground for B2B vendors looking to stake their claim.

Here’s why.

Filling the Financing Gap to Increase Customer Acquisition

Every gap in service your target audience experiences is an opportunity to differentiate your brand from the competition.

And the financing gap is no different.

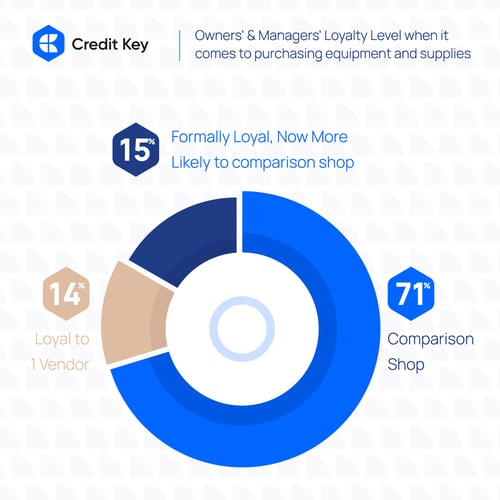

Incidentally, about 70% of B2B buyers conduct some form of comparison shopping before making a purchase. All other things being equal, a more specific and buyer-friendly financing option may be the reason a customer chooses to buy from you instead of a competitor.

On a deeper level, the presence of this more buyer-centric, yet non-traditional financing option shows your brand’s commitment to your customers. It shows you’re willing to break away from the pack — and perhaps experiment a bit — as long as it will benefit your audience.

In short, filling the financing gap will improve both the practical and perceived value of your brand.

In turn, you’ll easily begin to acquire new customers — and will likely be able to poach a fair amount from vendors that don’t offer the same accommodating financing options your brand does.

Filling the Financing Gap to Increase Customer Buying Power

While your target customers will have a variety of reasons for seeking out a more tailored financing option, it really all comes down to buying power.

Obviously, you’ll have many cases in which your customers can’t afford to make a desired purchase using the more traditional financing methods. If they need more than 90-day terms to pay off their balance, but you don’t allow it, well…you aren’t going to be making a sale anytime soon.

So, for starters, filling the financing gap actually makes it possible for many of your customers to buy from you in the first place.

It also increases their buying power for each engagement, as well. This means more opportunities for you to:

- Increase their order volumes

- Upsell more valuable products to them

- Cross-sell additional products and services to them

Many growing B2B companies have seen massive gains in these areas by introducing more modern, buyer-centric financing options.

- 10x Growth in Average Order Value

- 29% Increase in order Frequency

- 50% Boost in conversion rates

Really, it’s not hard to see how this happens:

The more buying power your prospective and current customers have, the more they’ll be able to buy from you as needed. And, as discussed above, giving them this buying power will do even more to nurture them toward making these higher-value purchases.

Filling the Financing Gap to Increase Customer Loyalty and Referrals

So far, we know that filling the financial gap will lead to an increased ability to attract and convert more customers — and to sell more to them during each sales opportunity.

You’ll also be providing a reliable, value-added service that helps increase your customers’ financial stability, overall. Thinking in these terms, the fact is that filling the financial gap in just one area for your customers can have a far-reaching impact on the rest of their financial situation.

Put this all together, and your customers will have very little reason to churn — and every reason to stick around.

(This is assuming the rest of your customer experience is top-notch, of course.)

What’s more, your satisfied customers will be more likely to spread the good word about your brand to others in their network — ideally those with similar financing needs.

This isn’t to say that providing better financing options alone is enough to generate more business and engagement from your customers.

But, if you’re doing everything your competitors are doing — while enabling your customers even more — you’ll easily create a following that will stay loyal for a long time to come.

So, What’s the Solution?

Okay, so we’ve established that today’s B2B buyers are looking for a middle-of-the-road financing option between the traditional net-90 and 12-month terms.

Now, the question is:

What, exactly, does that look like?

As we’ve discussed before, extending net terms beyond 90 days just isn’t an option for most small businesses. In most cases, having to wait three months for reimbursement and recognizing sales revenue is too large of a risk for most organizations. Furthermore, extending capital that long jeopardizes a positive cash flow for most suppliers.

Enter Credit Key’s Buy Now, Pay Later financing service.

Here’s how it works:

- Your customer selects Credit Key as a payment option at the point-of-sale.

- After a quick application process, the customer selects the payment plan that fits them best — extending up to 12 months.

- You process the order as usual.

- Credit Key reimburses you in full within 48 hours.

- Your customer pays Credit Key back over time.

Your customers get what they need on the financing terms they can afford — while you take on none of the financial burden.

For both parties, it’s win-win.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: B2B Payments E-commerce Finance B2B Sales