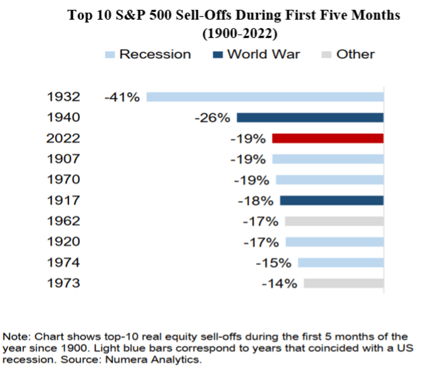

While we’re not officially in a recession in the United States yet, some consumers believe we’re already there, while other economists are saying there’s at least a 50/50 chance we will be in the next 6 – 18 months. Rising gas prices, increasing federal interest rates, and global instability are all factors, according to Richard Kelly, head of global strategy at TD Securities.

He’s not alone in his thinking, either. The World Bank’s latest Global Economic Prospects report notes that global growth is likely to drop from 5.7 percent in 2021 to 2.9 percent in 2022. And while consumer sentiment is at an all-time low, with high levels of concern about inflation and a potential recession, retail sales showed a modest 1 percent growth in June 2022.

For many small and medium-sized businesses, the picture of the future couldn’t be foggier, with nearly 50 percent of business leaders predicting a recession this year. Many are taking steps to protect themselves now in anticipation. Even tech companies, which have largely profited during recent economic turbulence, are facing a significant cooldown, with more than 53,000 employees at startups getting laid off. Even large firms like Netflix are battening down the hatches, laying off about 450 employees. Meanwhile, Microsoft, Meta (i.e. Facebook), and others have said they are slowing down their recruiting efforts.

Coming out of the pandemic, small businesses got shut down, while some vendors stopped extending credit to reduce risk. Which is unfortunate, given that it’s common wisdom that cash is king during a recession.

But not extending credit to some businesses may result in a domino effect, where B2B vendors are actually shooting themselves in the foot. The truth is that short-term net terms, which are the most common in B2B transactions, are simply not sufficient.

That’s where simple long-term financing comes in.

How Flexible Credit Works

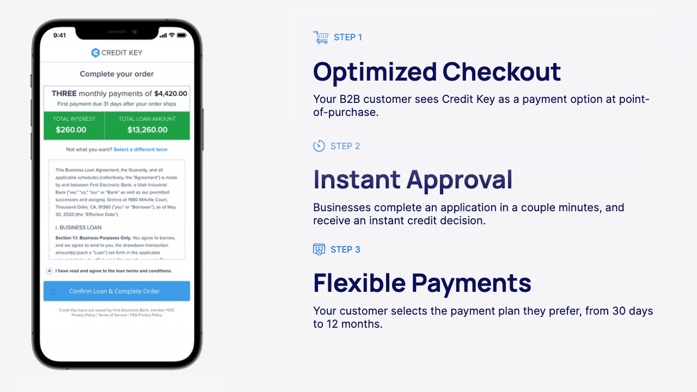

Instead of Net Terms being a one-size fits all approach, flexible credit and payment terms allow businesses to actively choose the term that fits that specific purchase at that moment. These can be as short as the traditional 30 days or as long as 12 months.

They’re also flexible in that customers have the option of how and when they pay their balance, but also in that customers can choose the terms that best fit their business. The “buy now, pay later” trend was popularized in B2C purchases, and offering something similar in B2B can have a significant, positive impact on a merchant’s revenue.

What’s more, businesses offering flexible credit don’t actually have to extend the credit themselves. For example, Credit Key’s proprietary technology can offer instant credit decisions, making transactions of all sizes frictionless and easy. Especially in comparison to the traditional way B2B businesses extend credit.

Best of all, this payment method mitigates a huge amount of risk for merchants while also increasing their own cash flow. Why? Because Credit Key assumes that risk for its clients and also pays them within 48 hours.

What Happens When Businesses Offer Flexible Credit

The outcomes seen when businesses switch to offering flexible credit to their customers is nothing short of impressive. Merchants have seen average order values skyrocket when offering flexible credit options. Case in point: Restaurant City, whose Credit Key transactions are valued at 600 percent more than other types of transactions.

With more capital available to them, business buyers can invest in their future—even during a recession (or to prepare for one). They can invest in new equipment that will help them be more efficient or expand their service offerings. They can buy the supplies they need to continue to operate, even when incoming cash is lower than expected. Ultimately, they can keep their business running smoothly in the face of economic instability, which in turn helps them pay workers and continue to grow.

Most importantly, by offering flexible credit solutions, merchants can do what many of their competitors can’t: Keep customers spending despite economic news. Merchants offering flexible credit can increase customer loyalty, allowing them to grow their business. In fact, small business buyers will often prefer to use a merchant where the purchasing terms are more aligned with their own needs. Think about it this way: When cash flow is tight, is a buyer more likely to spend $500 (or $50,000 for that matter) with a merchant who requires payment in 90 days or with one who requires payment in 180 days?

Whether a real recession is coming or not, it’s smart to be prepared. By offering more flexibility to how and when customers pay, merchants can continue to work on building their business with cash flow being one less thing to worry about.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: B2B Payments Finance