You’ve heard of the Pareto principle, right?

In the world of sales, the Pareto principle — also called the 80/20 rule — says that roughly 80% of a company’s sales and/or revenues will come from about 20% of their customers.

Generally speaking, this is pretty accurate for companies of any size, in any industry. All things being equal, the average company probably will generate most of their sales revenues from about one-fifth of their customer base.

But, the Pareto principle isn’t a hard-and-fast law.

Unfortunately, it’s often treated as such. Many times, teams operate under the assumption that the 80/20 rule will naturally “work its magic” — that 20% of their audience will naturally become VIP customers, while the other 80% are destined to remain “average” customers (at best) throughout their lifespan with the company.

To be sure, this isn’t the best approach to take — for a few key reasons.

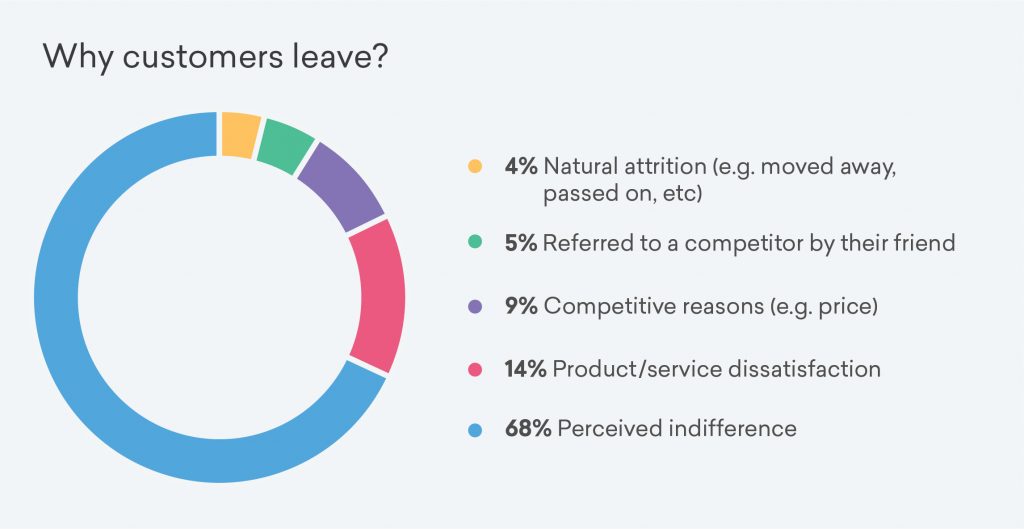

First of all, treating your non-VIP customers as…well, non-VIP customers…is a surefire way to keep them at this low-value status — if that. Really, treating your low-value customers with indifference is one of the main reasons buyers decide to churn.

Source

As for your VIP customers, the problem here is two-fold.

For one, they aren’t going to stick around just because they always have thus far. Again, assuming they’ll always stay at their current level without any effort on your part is definitely not the best course of action. What’s more, assuming your VIP customers have no further room for growth shuts the door on the possibility of generating additional value from them in the future.

The point is:

While understanding the Pareto principle can help you form your overarching approach to sales, taking it too literally can stunt your sales team’s performance across the board.

The solution, then, is to dig deeper into both your high- and low-value customers’ needs and overall circumstances to determine how you can better serve them — and, in turn, sell more to them.

Understanding Your Customer’s Financial Situation and Buying Power

Your high- and low-value customers are almost certainly in very different financial situations — and likely have very different purchasing habits because of it.

Understanding how these factors play into each other for both audiences is crucial to increasing sales.

This is especially important for your low-value customers, who may be facing cash flow issues that hinder them from doing further business with your company. For these customers, alleviating the financial burden is a must before upselling or otherwise selling more to them.

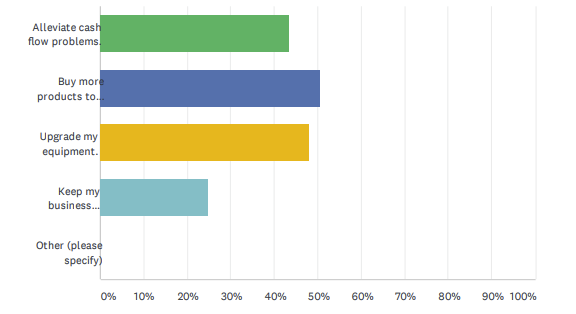

Reasons businesses use alternative financing

(As we recently found, 45% of small business owners say they use alternative payment solutions to alleviate cash flow problems — and 55% said flexible payment options are important to their purchasing decisions.)

Though your VIP customers are likely in a much better financial situation, they’ll always be looking for ways to save on their business expenses and keep cash flow moving in the right direction. Here, a more cost-effective and buyer-friendly financing option becomes an additional selling point — ideally leading to even more business from your already high-value customers.

Again, Credit Key’s survey found that 51% of businesses use financing options to buy more products to sell, while 47% finance equipment upgrades. If you don’t offer these options, even your best customers will become limited in how much more they can spend.

Understanding the financial needs of both your high- and low-value customers is vital, as it allows you to empower them to make the purchases they need to be productive. In turn, you’ll easily be able to increase sales across your customer base.

Understanding Your Customers’ Purchasing Cycles and Processes

Your high- and lower-value customers also likely have vastly different purchasing processes, as well.

A comprehensive understanding of these differences is needed to better serve and provide value to each of these customer segments.

Your high-value customers — typically larger companies and corporations — usually have lengthier sales cycles, along with more intensive sales processes. This leaves your sales team with a ton of opportunities to engage with and sell more to your VIPs buyers.

…and you should absolutely take advantage.

Marketing automation is huge here, as it enables you to deliver tailored content and offers to your regular customers at critical moments along their path to purchase. Replenishment notifications can also be used to increase purchase frequency and/or volume — which will lead to a massive spike in revenues generated from your top customers.

Your smaller customers often don’t have such elongated and complex purchasing processes, and are more apt to make quicker buying decisions.

(They’re also more likely to defect to your competitors if it becomes more convenient and most cost-effective to do so.)

To increase conversions amongst these customers, you need to allow them to act quickly and decisively.

This means:

Delivering crucial information (from your value prop to product specs) immediately

Streamlining your digital purchasing experience — even for guests

Engaging new buyers beyond the point-of-purchase via tailored content and offers

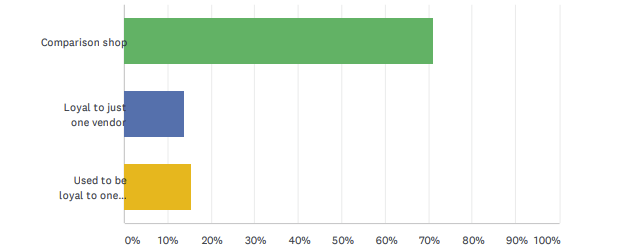

90% of small business owners choose to shop online for new equipment - 70% comparison shop - not staying loyal to a specific vendor

How small businesses shop for Equipment

In understanding how your customers make their purchasing decisions, you can give them exactly what they need to make informed purchases right when they need to. This, again, will lead to additional opportunities to sell even more to both your VIP and up-and-coming customers alike.

Don’t Let Customer Value Be a Self-Fulfilling Prophecy

Knowing who your high-value (and not-so-high-value) customers are is a good first step in selling more to them.

But your goal isn’t simply to identify which customers to focus on and which to ignore.

(That’s where the self-fulfilling prophecy comes in: If you’re only paying attention to your VIP customers, things will pretty much remain status quo sales-wise.)

Beyond labeling them based on the revenues they generate, your goal should be to understand how to better serve both your high- and low-value customers — not just at the point-of-sale, but throughout their journey with your brand.

Will 20% of your customer base still provide 80% of your business?

Probably.

But, in lifting sales throughout your customer base — and not just amongst this 20% — you’ll raise the bar for your company entirely.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: B2B Payments E-commerce Finance B2B Sales