As a growing B2B company, keeping close tabs on your DSO, DBT, and other A/R related metrics is crucial to staying cash flow positive — and keeping overall operations moving in the right direction.

So, it’s not exactly uncommon for owners and managers to work themselves into a frenzy as their A/R numbers start rising beyond expectations.

Quite often, they take rather drastic action, such as:

- Restricting their risk tolerance for new accounts

- Investing into new A/R and/or credit software

- Moving past due accounts to collections

- Buying credit insurance

- Partnering with new credit bureaus and databases

…and the list goes on.

Either way, when A/R and Credit metrics start to slide, most teams invest more in their processes in the hopes of improving the balance sheet and reducing risk.

The one factor that rarely gets any attention here?

The customer.

The Root Cause of a Common Problem

For most B2B vendors, the following story will probably sound pretty familiar:

A customer makes a purchase using net 30 terms, but fails to pay off their balance by the initial due date. After another 30 days passes, the customer finally agrees to pay using their business credit card.

This…isn’t a great situation for your company.

For one, waiting 60 days to recoup your earnings means 60 days of not having that capital to reinvest into your business. Worse yet, you have to pay an additional credit card transaction fee to actually receive your earnings as the transaction finally wraps up.

It’s easy to jump to the conclusion that those who seemingly game the system like this are “bad customers”. And, while it may be true in some cases, assuming the worst of your (eventually) paying customers just isn’t the right course of action.

Simply put:

A higher-than-average DSO is likely a sign that your customers need better financing options. Minus intentional delinquency, the only real reason they’d have for missing payments is financial woes…right?

As we’ve discussed before, even net terms aren’t enough for many small, growing businesses. In many cases, we’ve seen buyers use their business credit cards to continue financing purchases after their net terms have run out.

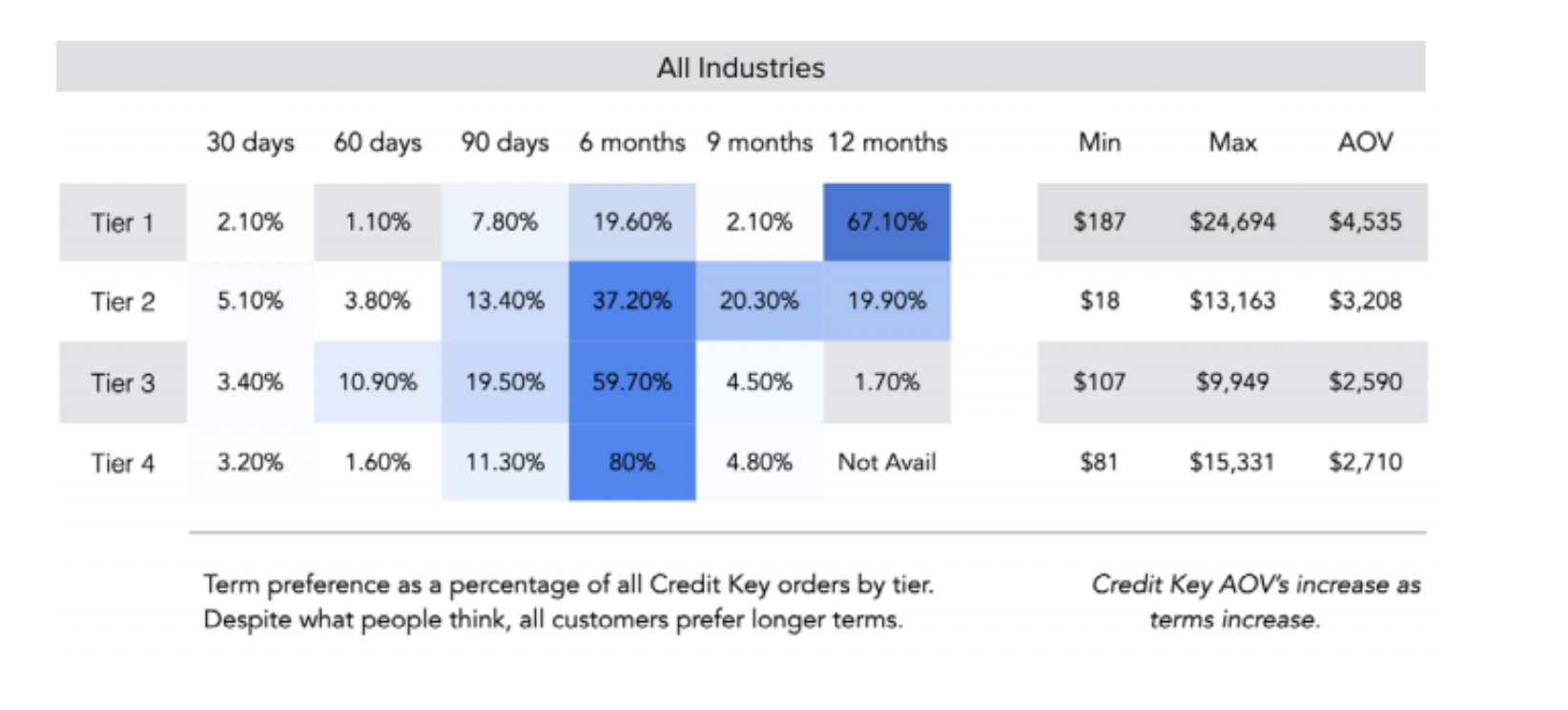

Actually, small business buyers 80% of the time choose payment terms past 90 days when given the option.

Even if they don’t say it out loud, your B2B customers will almost certainly appreciate having a more customer-friendly financing option to choose from.

In giving your customers what they need, you’ll not only solve your A/R and credit-related problems — but will actually open up some major opportunities for your business moving forward.

Here’s how.

Opportunities to Make More Sales

Okay, let’s start with the obvious:

If your customers can’t afford to make a purchase using current financing options, they aren’t going to buy from you. Actually, almost half of B2B buyers won’t even make a purchase if their preferred payment or financing option isn’t available.

It just makes sense, then, that adding a Buy Now, Pay Later option would increase conversion rates to at least some degree.

And it does.

After introducing a BNPL financing option:

- Olam Specialty Coffee increased their conversion rate by 250%

- Postcardmania’s conversion rate increased 7.3%%

Again, there are two main factors involved here: Necessity and preference.

If your customers need longer and more buyer-friendly payment terms, well…your only chance of converting them is to give them what they need. Otherwise, they’ll likely end up looking for more cost-effective solutions from your competitors.

(Or gaming their current net terms agreements, again to the detriment of your company.)

With regard to buyer preference, just offering BNPL financing as an option can paint your brand as progressive and customer-centric. Even in cases where a prospective customer doesn’t need to finance their first purchase, many will still see it as a check in the “pro” column when considering their options.

A BNPL option can be the reason a potential buyer decides to (or is able to) go through with a purchase. As BNPL becomes more prevalent throughout the B2B world, vendors simply can’t afford not to offer it to their customers.

Opportunities to Increase Order Value

On top of allowing vendors to make more sales, a Buy Now, Pay Later option can also help you increase the value of each sale you make.

In fact, PostcardMania saw a whopping 104% increase in AOV (Average Order Value) after adopting Credit Key. Another CreditKey client, Voltage Restaurant Supply, saw their AOV increase by 10x.

This again goes back to giving your customers more buying power: Those who have a need for your higher-value products will now be able to purchase them without blowing their budget — and without shortchanging your company, either.

(They’ll also be more apt to buy related products and services that they otherwise would not have been able to afford.)

Looking at this a different way, giving your customers more buying power via BNPL allows your sales team to more effectively upsell and cross-sell your customers. When a minor increase in spending will lead to a massive increase in value for the customer, your sales team can offer BNPL financing to ease them toward the additional purchase.

No matter how “routine” a given customer’s purchase history is, a better financing option — namely, BNPL — can again be just what they need to increase their spending and derive more value from your brand.

Opportunities to Increase Purchase Frequency and Build Loyalty

Finally, using BNPL to solve your buyers’ financing issues can lead to more frequent engagement and purchases — and can also build customer loyalty rather quickly.

As our case study with Ryonet shows, adding Credit Key helped them achieve an increase in purchase frequency by 29%.

It again comes down to necessity.

As before, your customers may not be able to increase their purchase frequency — even if it would benefit their business to do so. With more flexible financing terms, though, they can get more of what they need from your company when they need it most…without stretching their budget too thin.

This, of course, is bound to drive loyalty amongst your regular and VIP customers alike.

On top of that, there’s the added practicality of BNPL options like Credit Key. After their initial application process (which only takes a couple minutes, itself), your existing customers can simply choose the Credit Key payment option at checkout and continue on with their purchase as planned.

For your ecommerce buyers, convenience is key. Make it easy for your B2B customers to get what they need — with the financing they need — and they’ll have every reason to keep doing business with your company.

Buy Now, Pay Later: The Solution to A/R and Credit Problems — and Much More

As we said at the beginning, it’s not uncommon for teams to look inward once their DSO, DBT, and other credit-related metrics start creeping upward.

But it’s highly likely the root cause of the spike is simply your customers’ inability to pay on time.

Are there other reasons your A/R metrics can go out of whack?

Absolutely.

But overlooking your customers in your analysis of the problem will cause you to miss out on some huge sales opportunities — both now and in the future.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: E-commerce Finance B2B Sales Featured