The CleanFreak.com team’s mission is simple:

To empower their hygiene-conscious customers as they make the world a cleaner place to live.

Of course, maintaining an immaculate environment can be a pretty costly affair — especially for the larger schools, businesses, and other organizations CleanFreak.com serves. Even with CleanFreak.com’s economic approach to pricing, many of their customers rely on financing when purchasing new cleaning equipment and supplies.

So, the CleanFreak.com team set out on a mission to find a financing partner that could ease their customers’ monetary worries, while also delivering the top-notch service their buyers have come to expect.

Though they did hit a roadblock or two along the way, CleanFreak.com’s search ultimately led them to Credit Key.

About CleanFreak.com

CleanFreak.com opened in 1995 with a goal of delivering the best cleaning products and expert knowledge of the jan/san industry to customers all over the United States.

CleanFreak.com opened in 1995 with a goal of delivering the best cleaning products and expert knowledge of the jan/san industry to customers all over the United States.

Who are their customers?

As the team will tell you:

“Anybody looking to purchase cleaning equipment and supplies.”

From large companies, schools, and residential complexes, to small groups and individual consumers, CleanFreak.com just wants to help the world clean.

Previously operating under Rocket Industrial, CleanFreak.com was acquired by Kelsan in 2021. Since their conception in 1995, the team has stayed true to their roots by focusing on three core virtues:- Delivering high-quality, affordable cleaning products for multiple purposes

- Offering helpful advice to customers with various hygiene-related needs

- Providing a personal and personable touch to their digital customer experience

The Need for a “Just Right” Financing Option

To be sure, offering financing has long been standard practice for the CleanFreak.com team.

For one, they’ve extended NET30 terms to their individual and business customers alike. CleanFreak.com’s partnership with EquipMoney also allows them to extend lengthier financing terms on the larger purchases their business buyers need to make.

In more recent years, though, CleanFreak.com realized the huge gap this approach unintentionally left for many of their customers. That is, there was no “middle-ground” financing option for those needing more than 30 days to pay off their purchases — but who may not need or qualify for the long-term financing offered via EquipMoney.

In a perfect world, CleanFreak.com would have hooked up with Credit Key immediately…

Avoiding a Customer Experience Disaster

…but, as you surely know, we don’t live in a perfect world.

Unfortunately for CleanFreak.com, their experiences with a former equipment financing provider made this all too clear.

In short, the provider just wasn’t what they’d built themselves up to be.

Worse yet, it was CleanFreak.com’s customers who made this known to the team. Soon after forming the partnership, poor reviews, complaints, and customer service calls came pouring in regarding the third-party’s overall ineptitude.

Customers weren’t complaining about minor issues, either. Some chief complaints CleanFreak.com received over time include:- A lack of transparency regarding finance rates and policies

- A poor application process and user experience

- A sense of being rushed toward a decision without preparation

In many instances, this effectively ended any chance CleanFreak.com had of getting the buyer to convert. Since they couldn’t trust CleanFreak.com’s business partner, well…they likely didn’t see any reason to trust CleanFreak.com, either.

Ironically, things got even worse when their customers actually did use the third-party financing option. Again, complaints began to roll in regarding poor payment processes and, more importantly, financial disputes.

As Taylor Crain, eCommerce Specialist, explains, CleanFreak.com’s initial financing partnership “led to a lot of runaround and more overall work on our end to resolve issues that should have never existed in the first place.”

While CleanFreak.com’s team is always ready to tackle a messy situation, this isn’t the type of scenario they usually have in mind.

The message was clear: CleanFreak.com needed to wash their hands of their former partner and start looking for a provider that would actually provide for their financial needs.

Credit Key: A More Transparent & Polished Financing Solution

After an intensive search for a new equipment financing provider, CleanFreak.com happened upon a rather unconventional solution:

Credit Key’s Buy Now, Pay Later financing service.

After a short phone call, it was pretty clear to the CleanFreak.com team that Credit Key was exactly what they were looking for.

“What immediately drew us to Credit Key was their higher credit limits and on-the-spot approvals.” – CleanFreak.com Rep.

In stark contrast to their previous solution, Credit Key also offers easy-to-understand borrowing terms and transparent policies — which CleanFreak.com’s customers expect from a financing provider.

“Credit Key’s upfront and lenient approach to lending is a welcome relief to both our team and our customers.” - CleanFreak.com Rep.

And, because Credit Key is a direct lender, CleanFreak.com’s customers can be approved for more than they may need for a single purchase. They can then finance the rest when buying from CleanFreak.com in the future — instead of having to reapply for an exact amount every time they make a purchase.

“Credit Key essentially allows our customers to open up lines of credit with our company.” - CleanFreak.com Rep.

This ability to extend lines of credit to their customers opens up an exciting opportunity for CleanFreak.com to improve retention across the board. As Taylor Crain explains, “If a customer is approved for $5,000, but was only intending to spend $2,000 right away, we have a much greater chance of getting them to come back later in the year to spend the rest.”

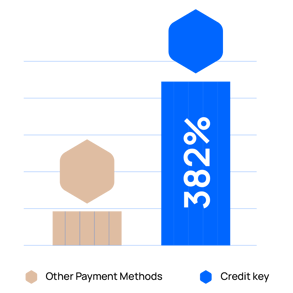

Customers that use Credit Key are also prone to spending more during every purchase they make. In fact, CleanFreak.com’s average order values for Credit Key-supported purchases is over 380% higher than their overall AOV.

On top of lauding Credit Key’s transparent and buyer-friendly terms, CleanFreak.com’s customers also appreciate the speed and ease of the approval and purchasing process. And, CleanFreak.com’s team maintains full control over the process — allowing them to further iron things out for their customers along the way.

Looking to the Future

While CleanFreak.com and Credit Key’s partnership is still pretty new, they already have some big plans for the future.

First on the list:

Automating the application and approval process — and integrating Credit Key with CleanFreak.com’s website.

"Enabling our customers to get instant approval and make their purchases right via our website without any additional steps will be a game-changer for CleanFreak.com.”

- Taylor Crain, eCommerce Specialist

From there, the partners will continue promoting Credit Key as an optimal financing choice for CleanFreak.com’s customers — and will work to keep these buyers informed and confident on their way to their first financed purchase.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: Case Studies