The B2B realm is evolving across the board — perhaps now more than ever before.

In recent years, the area of B2B payments has been especially impacted in a number of ways.

Today’s B2B buyers:

- Complete business transactions using a variety of payment methods

- Have a number of financing options at their disposal

- Increasingly rely on digital solutions to facilitate purchases

As the B2B payment landscape changes so drastically, a number of myths and misconceptions continue to bubble to the surface. In this article, we’ll take a look at six common rumors surrounding modern B2B payments — and discuss the truth behind these misconceptions.

Let’s dive in.

B2B Payment Myth #1: B2B Buyers Don’t Use Financing

Odd as it may seem, it’s not all that uncommon for B2B sellers to mistakenly believe that their customers don’t use financing at all when making business purchases.

This causes said sellers to forgo even offering financing as an option to their customers. After all, if their audience doesn’t need it, why offer it?

The problem, though, is that today’s B2B buyers do need financial assistance — period. According to PYMNTS, 57% of small- to mid-sized B2B buyers were late on their payments in 2020 — with 17% of these accounts being more than 30 days past due.

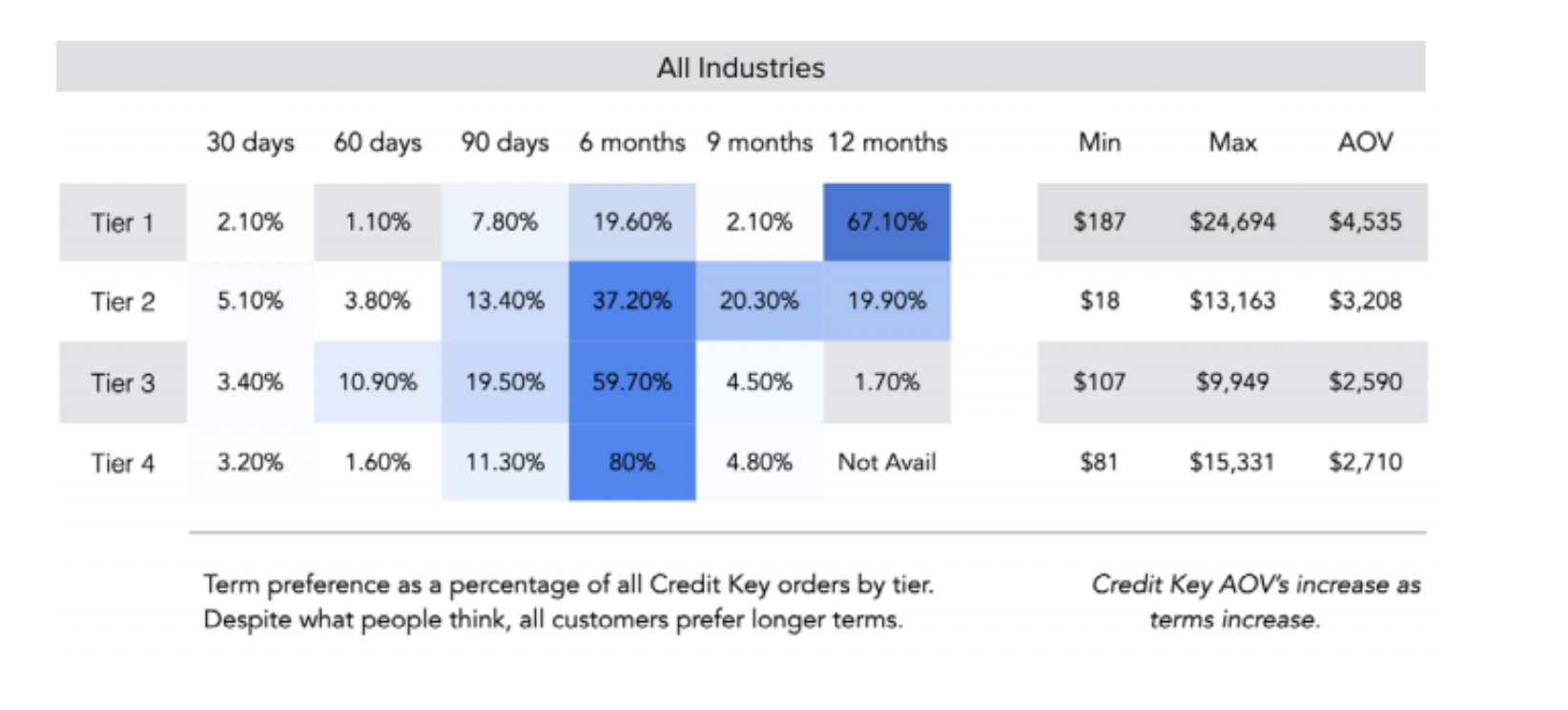

Our research shows that the average small business owner prefers financing terms past 90 days - 80% of the time.

(An untold number of businesses that delayed additional purchases — and even shut down operations temporarily — could also have benefitted from financing options.)

The fact is, financial uncertainty is bound to happen in the B2B world — both individually and on a grand scale. Allowing your customers to finance their purchases in some way, then, should continue to be a top concern for your B2B business.

B2B Payment Myth #2: Offering Modern B2B Payment and Financing Options Isn’t Important

Another misconception regarding B2B payments and financing has to do with the importance of providing options.

First things first, today’s B2B buyers use a wide — and ever-growing — variety of payment methods.

- 94% use business credit cards

- 51% use paper checks

- 50% make purchase orders

- 25% use digital payments and mobile wallet options

Similarly, today’s B2B buyers appreciate having multiple options when it comes to securing financing. While 53% of buyers look for net payment terms, a growing percentage of buyers use third-party financing options provided by their vendors.

For vendors, the takeaway is simple:

You need to offer the payment and financing options your customers expect you to offer.

The key part of that sentence:

Your customers.

You don’t necessarily need to accept every type of payment option available. If your customers don’t use mobile payments, for example, there’s no sense in offering it as an option.

(In fact, this might end up causing more problems than it solves.)

That said, failing to recognize when your customers do want to be provided these more modern payment options can be even worse for your business. To be sure, you don’t want a glitch in the payment process to be the reason a potential customer walks away from your brand.

B2B Payment Myth #3: B2B Financing is Too Complex

(Note to the reader: From here on we’ll specifically be focusing on myths surrounding POS financing in the B2B world.)

When it comes to payment processing, complexity is a major fear for B2B sellers.

Typically, this fear comes in one of two forms. In some cases, vendors say they don’t have the capacity to offer financing options to their customers. In others, vendors are wary of the process being too complicated on their customers’ end.

If we’re being honest, both concerns are valid — at least to a degree.

Yes, offering net terms or other in-house financing options may be a bit too much for a smaller team to handle for the time being. And yes, certain third-party payment options may be too complex for certain customers’ needs and use cases.

But, this doesn’t mean that all B2B financing options and processes are so complex.

In fact, providers like Credit Key exist specifically to eliminate the complexity of B2B financing. Our point-of-sale financing service ensures buyers can make purchases and vendors can get paid without having to deal with the complex, time-consuming processes that have traditionally plagued the B2B world.

The reality is, B2B transactions have always been complex by nature — with traditional payment and financing options being as complex as ever. While newer, emerging financing solutions are certainly more advanced in a technological sense, they all serve to keep this complexity to a minimum.

B2B Payment Myth #4: Offering Modern B2B Payment and Financing Options is Too Expensive

Remember earlier how we said that offering too many payment and financing options to your B2B customers can be damaging to your business?

Here’s where that starts to apply — and it’s where the myth that “offering B2B payment and financing options is too expensive” began.

In dispelling this myth, let’s again look to the more traditional B2B payment options for some context. As Paystand reports:

- Processing paper checks can cost upwards of $20 per transaction

- Transactions via credit card can cost nearly 5% of the total, plus applicable fees

- Cash transactions can cost businesses $15 for every $100 earned

Going the more traditional route by offering net terms to your B2B customers can also be expensive, in that it can reduce your business’ overall cash flow. Since you won’t be paid in full until your payment terms end, you’ll have less cash on hand to reinvest into the company in the interim.

It’s also worth mentioning that the traditional B2B payment and financing options are costly for buyers, as well. From credit card fees to APR owed on bank loans (and much, much more), B2B buyers should always be wary of the cost of their financial transactions in the first place.

That said, modern B2B financing options can actually be much more affordable than these traditional routes — for both buyers and sellers.

Here’s one of Credit Key’s current clients:

“My customers can get real-time financing with better and more cost-effective terms than credit cards. This not only saves them money in the long run, it allows them to focus more on running their businesses and less on worrying about financing.”

Is there a cost to offering modern B2B payment solutions and POS financing options?

Of course.

But there’s simply no truth to the misconception that it’s more costly than any of the other options that have always been at your disposal. In many cases, you’ll find these modern options to be the most cost-effective choices you have.

B2B Payment Myth #5: B2B Payment and Financing Options are Risky

Many B2B vendors worry that adding new payment and financing options to their services will open them up to a ton of potential security breaches.

And, well...they’re not wrong.

Really, adding any new service, channel, or platform on which your company and customers exchange financial information comes with an inherent risk.

But, again, it’s not these more modern solutions that are the most problematic.

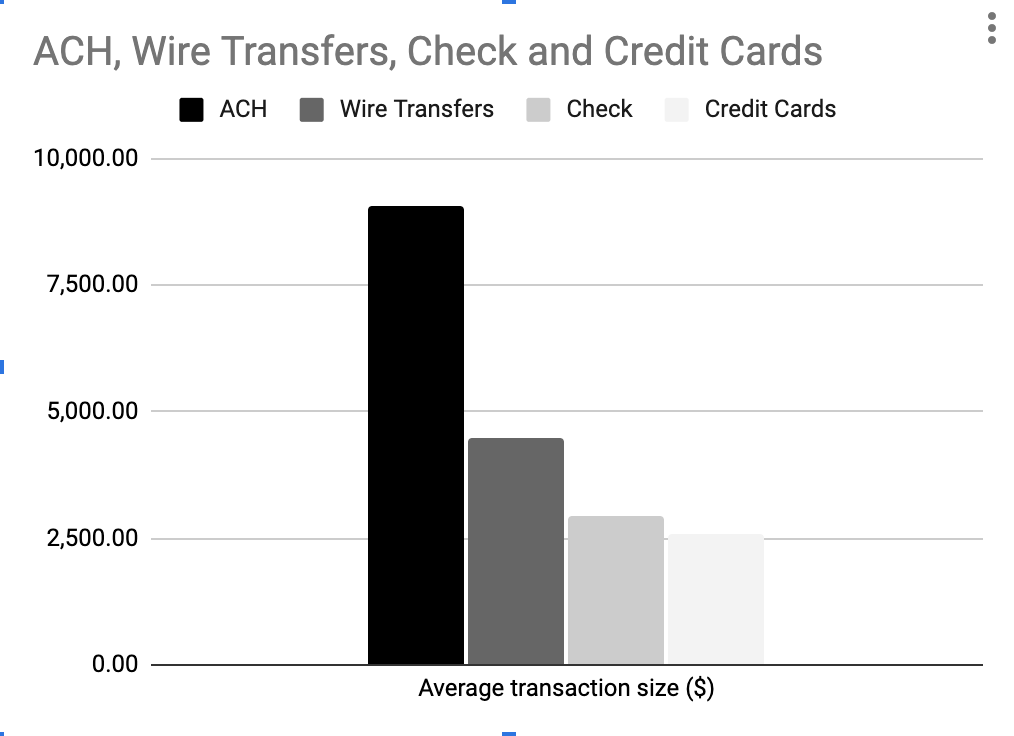

Rather, it’s the traditional transactional processes that continue to pose security risks for both B2B buyer and seller. According to AFP’s 2020 Payments Fraud and Control Survey, checks, wire transfers, and credit cards are the most common avenue for payment fraud to occur.

What’s more, 61% of all B2B payment fraud attacks occur via Business Email Compromise — which typically involves phishing and other such person-to-person hacking attempts. In other words, it’s human error that’s typically the cause of a security breach — which has little (if anything) to do with the digital side of things.

Really, it’s the emerging digital payment solutions that are likely to be most secure. For one thing, the automated nature of these services makes for a much lower chance of human error. What’s more, service providers are constantly looking for ways to improve the security behind their tools — and will almost always be a step ahead of the ne’er-do-wells that plague the industry.

B2B Payment Myth #6: The B2B Digital Payment Industry is Done Growing

Okay, we’ll be honest:

We don’t know anyone that actually believes this myth to be true.

The truth is, we’re really just seeing the start of an industry-wide digital transformation, overall. As more and more B2B companies hop on the digital bandwagon, we’re bound to see payment and financing options continue to evolve over time.

As things currently stand, these emerging services are already providing tons of value to B2B buyers and sellers alike. From convenient and streamlined payment processes, to mutually-beneficial financing options, providers are delivering exactly what both parties need to optimize their transactions and overall financial situation.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: B2B Payments Finance