One of the most important factors that determine whether a business is successful or not is if it maintains a positive cash flow. No business can expect to last if less money is coming in than is going out.

So what can a business do to fortify its cash flow when it offers 30, 60, or 90 day terms to its customers? Moreover, what can it do when its customers aren’t paying their invoices on time?

One option that’s quietly become popular over the years is invoice factoring. In fact, the industry has grown considerably, reaching an estimated value of $147 billion in 2021. The fact that businesses are looking for alternative financing options to improve their cash flow is probably no surprise, given the challenges the pandemic imposed on small and mid-sized businesses and the economy as a whole.

That said, invoice factoring is still a new concept to some businesses. The following comprehensive guide will help you not only understand what invoice factoring is, but how it may or may not be a good fit for your business.

What is invoice factoring?

Invoice factoring is an alternative financing method that involves a business selling their outstanding accounts receivable invoices to a third party for cash, typically 70% - 90% of the invoice’s value. The third party then collects the full invoice amount from the customer it was issued to. Once the third party receives payment, they pay the balance of what is owed to the seller, keeping a percentage of the total amount as a service fee.

This frees up cash for the business, enabling them quick access to operating capital at a fairly low cost.

It’s important to know that there are two types of invoice factoring:

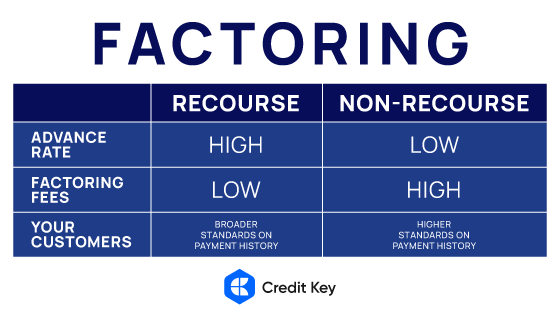

Recourse factoring

This requires the business to buy back an invoice from the factoring company if the buyer does not pay it by the end of the term.

Non-recourse factoring

The factoring company takes on the risk of a non-paying buyer by not requiring the seller to buy back the invoice in the case of nonpayment.

Firms offering non-recourse factoring charge higher fees to account for their increased risk. Recourse factoring, however, is more common, placing the risk of nonpayment on the seller using the invoice factoring service.

While it’s similar in nature, it’s important to distinguish invoice factoring from invoice financing. Invoice factoring is an outright purchase of an invoice, where invoice financing is a loan against the value of the invoice. In other words, invoice financing uses invoices as collateral where invoice factoring treats invoices as a commodifiable asset.

Invoice factoring is good for almost all business types, however, it is extremely useful for companies that require a significant amount of operating capital at all times. Thus, companies like distributors and manufacturers can make use of this financing method, allowing them to continue to keep cash on hand to fund operations, buy necessary raw materials or supplies, and even pay their employees. In short, invoice factoring provides businesses with significant flexibility in their day-to-day operations.

How does invoice factoring work?

First, it’s important to understand the different parties involved in invoice factoring:

- Buyer: The company making the purchase.

- Seller: The company selling the item(s) and issuing the invoice

- Factoring company: The company purchasing the outstanding invoice from the seller.

There are essentially six steps in invoice factoring:

- The seller sells a product to the buyer, issuing an invoice with payment terms of 30 to 90 days.

- The seller then sets up an account with a factoring company (if they don’t have one already).

- The seller submits the outstanding invoice to the factoring company.

- The factoring company then provides the seller with cash based on the pre-agreed upon percentage or a percentage based on the buyer’s creditworthiness.

- The buyer pays the invoice to the factoring company.

- The factor sends the remaining amount to the seller, minus any fees.

For example, let’s say a business has bought some equipment from a seller for $10,000. The seller would like to stay cash flow positive, and sells the invoice to an invoice factoring company. The factoring company pays the seller $9,000 or 90% of the original invoice. Later, when the invoice is due, the business that bought that equipment pays the invoice for the full $10,000. The factoring company takes a $200 fee and sends the remaining amount of $800 to the seller.

To give you a better sense of how this works, here’s a sample timeline of a company using invoice factoring:

- Day 1: Buyer places a large order with a seller.

- Day 15: Seller fulfills order, but is left with a shortage of raw materials. They need to work on fulfilling other orders, and need cash to buy more materials. They turn to an invoice factoring company, who agrees to give them 85% of the invoice and a 3% fee. The seller receives the cash instantly.

- Day 29: The buyer pays the outstanding invoice directly to the factoring company. The factoring company then pays the seller the remaining amount, minus their fee.

There are essentially two different ways that factoring companies can structure the relationship with a seller.

- Spot Factoring: Businesses sell individual invoices at a time. Generally speaking, factoring companies prefer to avoid this structure, as they are less valuable. Most factoring companies will charge higher fees and repayment terms will likely be stricter.

- Contract Factoring: Factoring companies sometimes structure an ongoing relationship with a business to factor their invoices, where they purchase a certain number of invoices each month. Most factoring companies have a minimum value where they’ll offer this type of relationship, collecting invoices for the length of the contract. While generally less advantageous to small businesses, the one benefit is often lower fees. That said, there is not a lot of flexibility for the seller overall regarding payment terms and fees.

When should you use invoice factoring?

While on the surface it might seem that invoice factoring should only be used when you face a cash crunch. To be sure, invoice factoring is an excellent tool to use when a business experiences an uneven cash flow. But invoice factoring can be a real help to businesses in a variety of situations.

Possibly the most important one is when a business needs to make capital investments in order to continue to grow. This is particularly important when a business cannot obtain capital from more traditional sources, such as a bank. This could be because the business has poor credit history, past bankruptcies, or is currently operating at a loss, among other reasons.

For example, an office furniture distributor may want to use invoice factoring to increase cash on hand that it can use to replenish stock levels during an unexpectedly high sales volume period. Or maybe a kitchen equipment manufacturer turns to invoice factoring in order to upgrade its factory machines, which in turn increases operational efficiency.

Another potential use for invoice factoring is offering your own customers longer payment terms. Many small and mid-sized businesses do not have the financials to allow them to offer payment terms longer than 30 days. But that becomes less of an issue with invoice factoring. Using this method, firms can offer qualified customers longer payment terms of up to 90 days and lean on invoice factoring to collect the majority of that invoice faster. This enables them to maintain positive cash flow while giving their buyer greater flexibility.

Of course, there are many more scenarios where invoice factoring makes financial sense for a business. But generally speaking, it is useful any time where cash flow is needed.

How do companies qualify for invoice factoring?

Qualifying for invoice factoring involves applying for and opening an account with an invoice factoring company. While some application questions may vary, most factoring firms request the following basic questions:

- Does your business sell products or services to other businesses or the government?

- Does your company’s annual revenue exceed $50,000?

- Are your clients expected to pay in 30 to 90 days?

- Are your clients creditworthy?

Factoring companies may also require you to provide a number of financial details and reports to consider your application. These include (but are not limited to):

- An accounts receivable aging report

- A business bank account

- A tax ID number

- A form of personal identification

Keep in mind that some invoice factoring companies may want more or less information to qualify you, and each will likely have their own unique process.

Additionally, the most important factor that goes into whether or not your application is approved or denied is your own customers’ creditworthiness. If your business has multiple customers who regularly pay invoices late, it is less likely an invoicing factoring company will be interested in conducting business with you. Conversely, the more that buyers pay on time without any hitches, the more likely an invoice factoring company will approve your application. In fact, they may even offer lower fees in some cases, as long as they feel confident the buyer will pay in a timely manner.

Invoice Factoring Pros & Cons

Like anything in business, invoice factoring has both pros and cons. Whether it’s your first time using a factoring service or your 100th, there are important tradeoffs that you should seriously consider before proceeding.

Invoice Factoring Pros

- Fast access to cash: You get access to a significant amount of cash, typically within 24 – 48 hours.

- No credit score impact: Selling invoices does not have an effect on credit scores because they are not a form of credit.

- Faster approval than a bank loan: Traditional banks often require a significant amount of time to review and approve a loan application. Invoice factoring companies have their own proprietary algorithms and methods for this process and can typically respond to requests faster.

- Less scrutiny of personal credit history: Business loans are often dictated by the owner’s own personal credit history. But because invoice factoring does not require an extensive credit check, an owner’s own credit history is typically not relevant. Invoice factoring companies are much more interested in the buyers’ ability to pay invoices.

- High approval ratio: If your customers regularly pay on time, you are more likely to be approved.

- Less expensive than invoice financing or other traditional financing options: Invoice factoring fees are generally lower than other forms of business financing.

- No collateral needed: Other than the invoice—and your promise to buy it back if it goes unpaid (and if you’re using recourse factoring)—you do not need to put any other material or financial assets up for collateral.

- Less work for your staff: Accounts receivables staff don’t have to spend hours and hours of work following up on unpaid invoices.

- Allows you to offer better payment terms: Most small and mid-sized businesses are somewhat limited in the length of terms they can offer to their customers. Invoice factoring, however, allows them to offer longer terms, up to 90 days. Because they get paid quickly once an invoice is factored, it does not matter as much whether the payment terms are 30, 60, or 90 days. This gives a business’ customers more flexibility and potentially more reason to become a repeat buyer.

Invoice Factoring Cons

- Lower profit: As mentioned above, invoice factoring companies charge fees for their services. That ultimately lowers your own profit.

- Approval relies on customers: As mentioned above, your approval for invoice factoring is more largely dependent on your own buyers’ companies’ creditworthiness; your application may be jeopardized if they have a poor credit score.

- Payments not guaranteed: Even the best buyers sometimes fall behind and don’t pay their invoices in a timely manner.

- Potentially expensive: Despite upfront fees generally being smaller than traditional financing vehicles, an invoice factoring firm’s fees will likely be higher than interest loan payment in the case of nonpayment.

- Potentially riskier: There is some level of risk when using recourse factoring, where the seller is required to buy back an invoice that has gone unpaid.

- Hidden costs and fees: Not all invoice factoring companies are built equally. Some may try to sneak in a hidden fees for applications and credit checks. They may also try to hide high interest rates for unpaid invoices, for which you will possibly be responsible. Be sure to read the fine print and get a clear list of all fees, interest rates, etc.

- Potential Threat to Customer Relationship: When you factor invoices, your customers are contacted by the factoring company to advise that they now own the customer’s debt. This might pose some challenges, such as your customer being confused why they need to pay their invoice to a third party. They may not trust the factoring company, and being forced to have a financial relationship with them may leave a bad taste in their mouth.

Invoice Factoring vs. Other Small Business Lending Options

Of course, invoice factoring is one choice among quite a number of other options businesses have. It’s always a good idea to explore all choices in order to make the best decision for your business.

Here are a few other short-term financing methods you may want to consider.

Invoice Financing

Also called Accounts Receivable Financing, invoice financing is the B2B equivalent of a pay day loan. A lender basically gives a business a short-term loan using outstanding invoices for collateral. The loan amount is based on the total of the outstanding invoices, with fees interest being charged to the borrower that can amount to as much as 30% of the value of the invoices.

While this method of financing offers many similar advantages to invoice factoring, including speed of funding and flexibility, it can be significantly more expensive. What’s more, the risks associated with nonpayment are essentially doubled; where an unpaid invoice simply means a lack of cash, an unpaid invoice that has been leveraged can collect significant interest the longer it goes unpaid. That can seriously eat into a company’s profit.

Invoice Discounting

Invoice discounting is very similar to invoice financing. In this option, a business will take a loan from a third-party lender valued at a percentage of the firm’s outstanding invoices, often about 80% of the total outstanding invoices less than 90 days old. The borrowing business retains responsibility for collecting on the outstanding invoice and pays off the loan when the invoice is paid. The invoice discounting company charges both fees and interest on its loans, which can often be significant.

There are two types of invoice discounting:

-

- Whole turnover invoice discounting: Businesses leverage the entire value of their accounts receivable ledger, which enables them to take larger loans.

- Selective invoice discounting: Businesses select which invoices to use as collateral for the loan.

One of the biggest advantages in invoice discounting (and financing for that matter) is that the financing all takes place between your company and the lender. That is, your customer only ever interacts with you, while the third party remains confidential. In invoice factoring, of course, they must engage the third party that has bought the invoice.

Account Receivables Trading

This is a particularly useful alternative financing solution for companies that have contracts with customers who are considered “high-quality,” i.e. multinational companies or government agencies. Not only does this form of financing allow you to take loans on unpaid invoices, but you can also “trade” purchase orders, approved contracts, or other evidence of future recurring revenue. What’s more, borrowing firms can also receive additional financing in addition to the loan based on their accounts receivables.

In receivables trading, funds are actually pooled by other participating organizations, typically institutional money managers that handle liquidity for insurance companies, pension funds, professional investors, and other financial institutions.

Bank Loan

Most businesses are familiar with traditional bank loans. Most often, these are short-term loans designed to be paid off fairly quickly, but they can also include longer-term capital investment loans. Interest rates can vary, depending greatly on risk, amount, term length, credit score, etc.

There are a number of distinct disadvantages when it comes to bank loans. First, it’s important to note that the loan process can often take several days or longer, which in turn can make it difficult to maintain positive cash flow. Additionally, banks will likely place a limit on the total amount a firm can borrow, whereas the limit is based on the total value of the outstanding invoices (or future revenue) in invoice factoring or the other financing vehicles discussed here.

Lastly, the borrower often needs to have at least a good relationship with the bank, if not a fairly good credit history in order to obtain loan approval. In this sense, bank loans can be extremely invasive to the business owner.

Credit Cards

In case of an emergency need for cash, there’s always credit cards. Credit cards often offer a lot of flexibility and ease of use, but that usually comes with very high interest rates for unpaid balances. Obviously, credit cards can be used up to their allowed credit limit, which is likely higher than what a business may be able to get through some of the alternative financing methods discussed above.

Aside from the high interest rates, the biggest downside is that credit cards don’t necessarily solve cash flow issues. You can’t use a credit card in all situations, such as in payroll.

Deciding Which Financing Option Is Best

Given all the choices for financing, it’s good to remember that there are tradeoffs with each one. There is no one-size-fits-all when it comes to alternative financing, and different situations may call for different financing vehicles. It’s important to evaluate each option available and make decisions based on their impact on cash flow and profit margins.

Yet another option: Credit Key. Credit Key is more of a “buy now pay later” credit system, which takes a more hybrid approach. Businesses can offer their customers payment terms through Credit Key that can be as long as 12 months. When a buyer chooses this as a payment option, the seller gets paid within 48 hours, and Credit Key assumes the responsibility of collecting payments from the buyer. Buyers pay interest on their Credit Key line of credit.

This approach completely removes the seller from having to worry about repaying a loan, paying late payment fees when their buyer doesn’t pay, or a host of other issues that are beyond the seller’s control. In fact, the seller receives the full amount of the invoice and all additional costs are the buyer’s responsibility.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: B2B Payments Finance