When it comes to financing, today’s small businesses have a ton of options to choose from.

Still, it’s not uncommon for owners to rely on traditional business credit cards to finance certain purchases. In fact, the US Small Business Administration found that 65% of small businesses use business credit cards in some capacity.

To be sure, business credit cards can be pretty helpful to your financial situation in many ways.

But:

They aren’t always the best financing option at your disposal — and relying too heavily on them can unwittingly lead your business to financial ruin.

4 Reasons Why Business Credit Cards Fall Short for Small Businesses

Here, we’ll take a look at the key reasons you might not want to open a business credit card — and instead look elsewhere for potential financing for your company.

1. Credit Limit Restrictions on Business Credit Cards

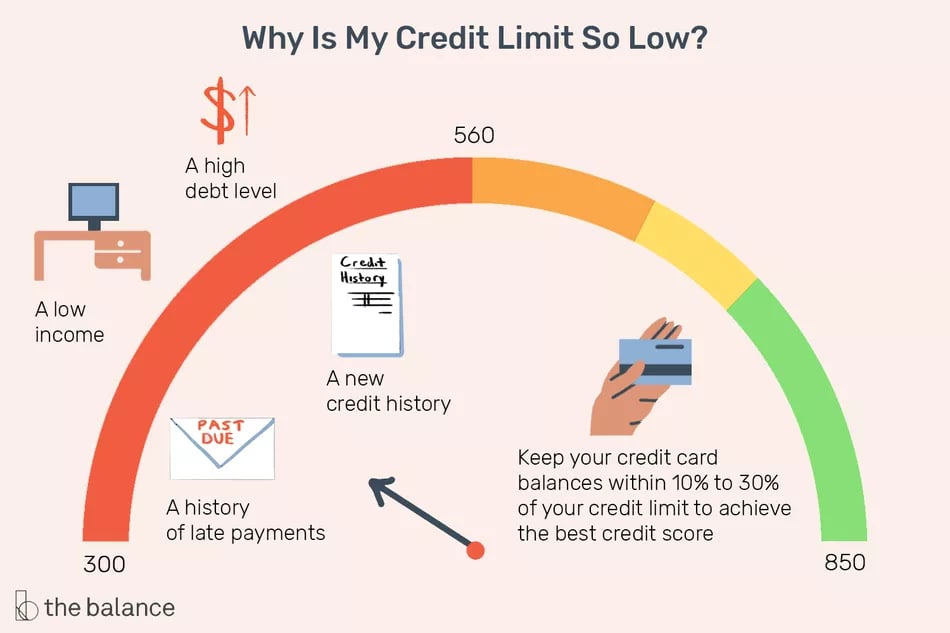

Because small businesses have relatively short credit histories, they’re typically offered smaller lines of credit until they’ve proven their trustworthiness.

Of course, this means building up their credit history by continually paying off the line of credit in question — along with any other loans or credit lines they have open at the time.

While this isn’t impossible, it will still take time to make it happen. In the meantime, making large purchases with your business credit card will likely be out of the question.

And, even if you’ve earned a higher credit limit, using your business credit card to make large purchases is still risky. Since you’ll still be using it to finance other, more routine business expenses, a more expensive purchase will push you ever closer to your credit limit. Get too close, and you’ll need to find an alternate way to finance your daily expenses until you pay down your balance.

2. Potential for High APR

Across the board, business credit cards often offer some of the highest APRs of any financing service around — often going as high as 40% for small businesses with minimal credit history.

In other words, if you aren’t able to pay off your balance as you’d agreed, you’ll be hit with a pretty exorbitant penalty.

This, again, makes large purchases via credit card pretty much out of the question: If you’re struggling to afford the large purchase in the first place, you almost certainly won’t be able to pay off your credit card balance before interest kicks in.

3. Purchases Pile Up

Keeping APR in mind, it’s crucial to understand that, when using a credit card for any given purchase, you’re not just financing that expense.

Rather, you’re financing everything that was already on the card’s balance, plus the purchase you’ve just made. In essence, this means you’ll be paying off each of these purchases equally until the balance of the credit card is paid off in full.

Yes, on paper it works out the same as if you’d have financed each purchase separately under the same terms.

But, realistically, this process tends to keep small businesses in debt for longer than they otherwise would be — while paying an increasing amount of fees the entire time. This is why small businesses commonly look for credit lines or loans instead, as seen below:

4. Immediate Needs Get Pushed Aside

In an attempt to keep their balance as low as possible, small businesses sometimes take a more lean approach to using their business credit card.

What sometimes happens here is, teams will wait to make larger purchases until they actually have the capital on hand to pay off their balance. While it’s one thing to be strategic with your small business finances, it’s another thing to avoid making necessary purchases in the interest of keeping your credit card balance down.

...especially when there are other financing options available.

Speaking of that:

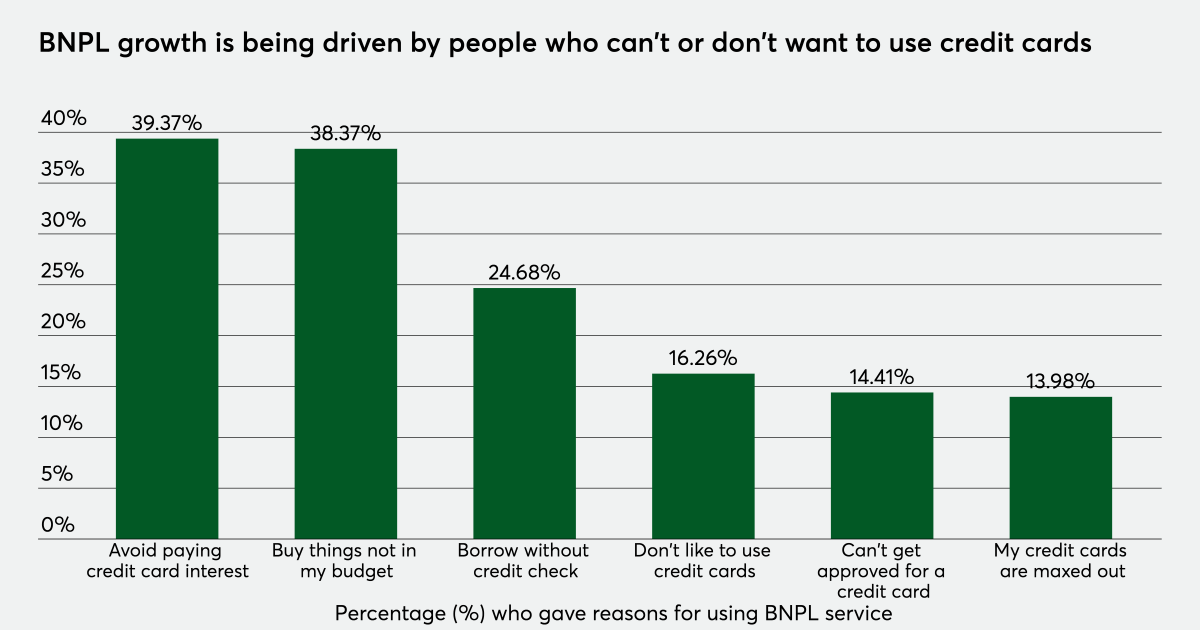

How Buy Now, Pay Later Differs From Business Credit Cards

For a small B2B business looking to finance a large purchase, credit cards simply aren’t the best solution available.

This is where Buy Now, Pay Later B2B solutions come into play.

With BNPL, you can finance large orders without any of the negative repercussions mentioned above. By keeping large purchases and everyday expenses separate, you’ll keep your credit card balance down — and can potentially get a better rate on the “big picture” items that will take some time to pay off.

Companies that utilize Credit Key also are able to buy products now without saving for the full price of the product. By easily breaking down the cost into flexible payment plans, small businesses are able to choose a plan that is easiest for them to get the products they need without jeopardizing their cash flow or working capital.

Merchants offering Credit Key make it easy for their customers to make large purchases comfortably. In turn, our clients see an increase in Average Order Value, conversion rates, and order frequency.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: B2B Payments Wholesale