“You’ve got to spend money to make money."

It’s true at any stage of running a business. From day-to-day expenses to major purchases, owners must constantly be investing cash into their business to ensure sustainability and growth.

Of course, if you don’t have the cash on-hand in the first place, business can easily come to a screeching halt — perhaps for good. Unfortunately, 82% of failed small business owners cite poor cash flow as a main reason for their failure.

Instead of letting things stagnate (and eventually fall apart), your best bet when short on cash is to consider your B2B credit options.

What is B2B Credit?

“B2B credit” covers a wide spectrum of financing services used by B2B companies to fund business operations.

Today, B2B companies can obtain financing through a number of methods, such as via:

- Small business loans

- Business credit cards

- Net terms

- Buy now, pay later

Some B2B financing services, such as loans and lines of credit, are provided by third-party financial institutions. Others, such as net terms, are typically offered by B2B vendors as a courtesy to their clients.

(As we’ll discuss, BNPL services are also offered by third-party companies like Credit Key in partnership with specific B2B vendors.)

How Do B2B Companies Use Credit?

While there’s a near-infinite number of ways B2B companies can use different credit services, the three “big picture” uses for B2B financing are:

- To fund startup and operational costs

- To handle emergency situations

- To scale operations upwards

Let’s look at each of these in a bit more detail.

Funding Startup and Ongoing Operational Costs

Getting your B2B business up and running is a costly venture in itself.

From rent and utilities, to new equipment, supplies, and inventory, to payroll, travel, and lodging, you’re going to be spending much more than you’re bringing in for at least a little while. As lean as you may try to keep operations for the time being, you’re probably going to need financial assistance of some kind to keep things moving.

On a small scale, a business credit card can give you some much-needed extra time to pay off your routine expenses. Business loans can help those looking for a lump sum to fund various startup costs. Finally, vendors offering net terms and Buy Now, Pay Later funding options put more purchasing power in the hands of startup teams.

While Net Terms, can help a business manage their Working Capital by postponing payment by 30 or 60 days, Buy Now, Pay Later (BNPL) offers longer payment options.

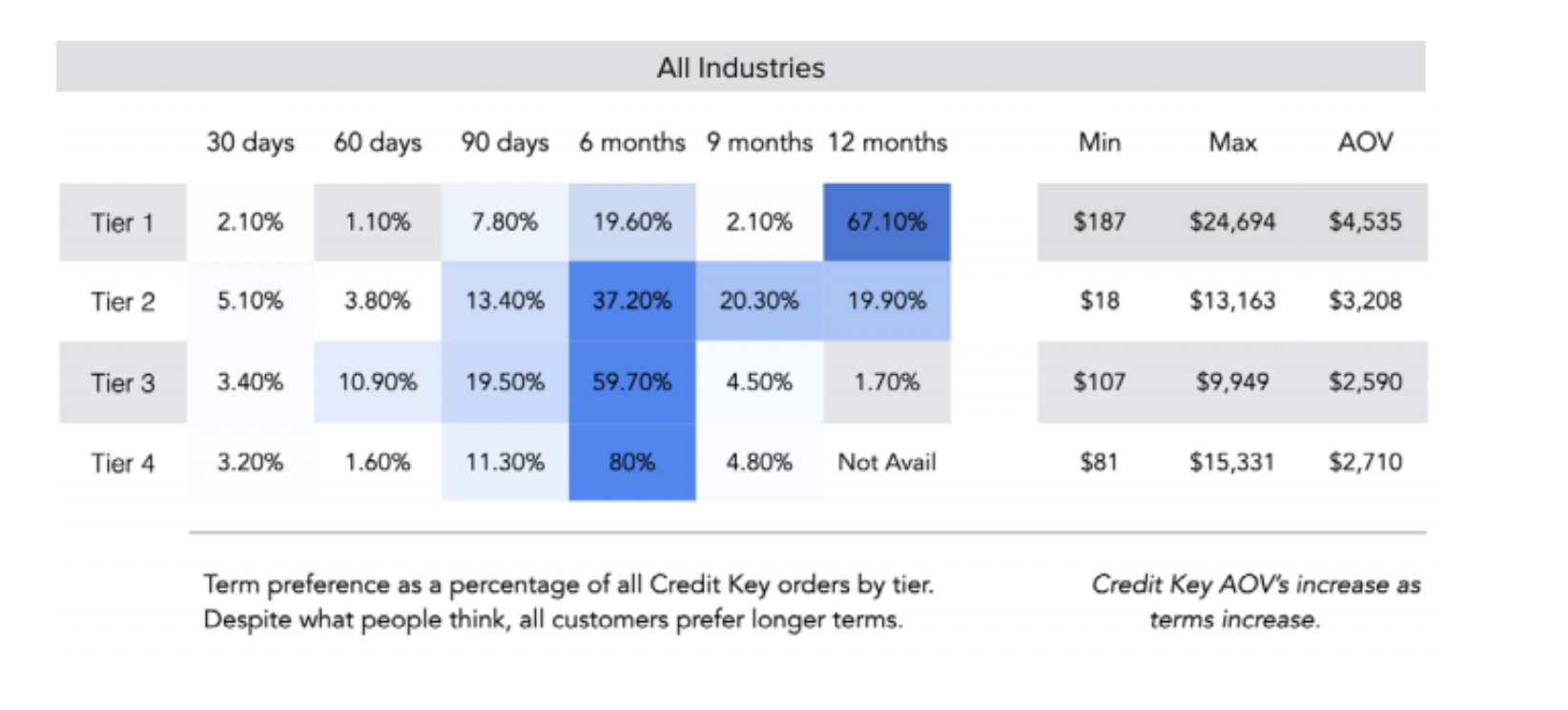

Credit Key has found that small business buyers when given the chance to choose a payment term, 80% of them choose terms longer than 90 days.

Handling Emergency Situations

If the past couple years have taught us anything, it’s that emergency situations can and will arise throughout your company’s lifespan.

Whether you’re facing a global pandemic or internal disaster, staying financially stable during these times is crucial to future survival.

Depending on the situation, you may need additional funding:

- To make purchases directly related to the disaster you’re facing

- To continue making routine purchases that you’d otherwise pay in cash for

- To offset the disruption in cash flow and maintain a “nest egg” to some degree

Again, this may mean opening a new business credit card account, requesting extensions on long-term payments, or securing more substantial loans from a bank or other financial institution.

In any case, a loan or line of credit can ultimately be the reason your B2B company survives its next unanticipated emergency.

Investing in Business Growth

On a more positive note, B2B credit services can also be used to spur business growth in a variety of ways.

If you’re looking to ramp up orders to accommodate for an increase in sales, you might need:

- Longer repayment terms

- Larger financing amounts

- Higher credit limits

If you’re looking to expand to new markets, the right small business loan will ensure you have all your operational costs covered. Still, the purchase-specific options we’ve mentioned can also help keep your cash flow steady as you look to the future of your business.

Key Barriers to Securing B2B Credit — and What to Do About It

The most common barriers B2B teams face when trying to secure credit are closely related.

First, new business owners may not have the credit history needed to be approved for much-needed loans and lines of credit. If the lender has no information to go on, you might not be eligible to receive the amount of funding you’d anticipated. In many cases, vendors won’t extend financial assistance to new customers simply as a company policy.

Similarly, a less-than-stellar credit history can be a red flag to lenders and creditors. Again, this can preclude you from getting the funding you need — and may cause you to put your goals on hold while you get your credit history in good standing.

Finally, the costs associated with B2B financing can eat into your profit margin well into the future if you’re not careful. And, to be sure, these costs will be even higher if your credit score is on the low side.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: Finance