Today, one of the biggest growth levers for wholesalers and distributors its at the checkout. Flexible payment solutions have gone from nice-to-have to non-negotiable, reshaping how businesses decide where and how much to purchase.

In this article, we’ll explore why payment flexibility is becoming the new competitive advantage in B2B, and how merchants can measure its ROI with clarity.

Why payment flexibility matters in B2B

In B2C, purchases are often quick, emotional, and relatively low risk. But in B2B, the story is different. Orders are larger, approvals are slower, and cash flow management plays a central role in every buying decision. That’s why the payment experience is becoming one of the biggest factors influencing whether a purchase gets made or not.

Many businesses, particularly SMBs, operate on thin margins and face unpredictable cash cycles. A rigid payment structure can delay or even prevent transactions altogether, creating friction for buyers and lost revenue for sellers.

For B2B buyers, payment flexibility directly supports three critical priorities:

- Cash flow management: Aligning outgoing payments with incoming revenue cycles.

- Risk reduction: Avoiding overcommitting capital on large or unexpected orders.

- Convenience: Accelerating purchase decisions by reducing credit approval bottlenecks.

.png?width=342&height=192&name=blog%20mockups%20(1).png)

On the other hand, when buyers are offered flexible financing, whether that’s splitting payments into installments, net 30 terms, or financing larger purchases over time, the barriers to buying are dramatically reduced.

A recent B2B study by Allianz Trade showed that:

- Merchants offering BNPL have seen a 40% increase in sales conversion rates.

- Merchants offering credit financing have seen a 60% average increase in order size.

- 29% of B2B buyers abandon their shopping carts if there is a lack of flexible payment methods.

This data shows that offering flexible payment terms can be a clear driver of growth for B2B merchants.

How flexible payment solutions drive conversions

When it comes to converting B2B buyers, price isn’t the only deciding factor. Timing and cash flow often matter just as much. Even buyers who want to make a purchase may abandon an order entirely if they can’t make the payment terms work for their particular situation. That’s where payment flexibility proves its value.

Research shows that over half of SMBs would switch suppliers if another vendor offered more accommodating financing terms. That number is significant, and it signals that payment terms alone can determine whether a customer chooses you over a competitor.

The buyer preference for flexible payments is pretty straightforward:

- It reduces payment anxiety: 61% of SMBs report facing issues when making payments. Buyers will be less likely to hesitate or abandon their cart when options like Pay in 4, net 30 payment terms, or extended terms are offered at checkout, in store, or over the phone.

- It encourages larger orders: When buyers don’t have to pay everything upfront, they’re more likely to increase order quantities or add higher-value items.

- It enables faster decision-making: Flexible terms can eliminate delays caused by internal approvals, helping buyers act quickly on opportunities.

For wholesalers and distributors, this translates into a measurable boost in conversion rates. Credit Key data shows that merchants offering embedded financing see both higher order completion rates and higher average order values compared to merchants who only offer rigid terms or traditional financing methods.

Why flexible financing increases customer loyalty

Conversion rates are important, but the true ROI of payment flexibility comes from what happens after the first purchase. In B2B, long-term customer relationships often drive the majority of revenue. Payment options that reduce friction don’t simply close a single deal, they encourage buyers to return again and again.

Research shows that acquiring a new customer can be anywhere from five to 25 times more expensive than retaining an existing one, and that even a 5% increase in retention can boost profits by 25–95%. Financing is one of the most effective levers merchants can pull to encourage retention, because:

- Predictability builds trust: When buyers know they can spread costs over time without hidden fees, they’re more likely to see a supplier as a reliable partner rather than a transactional vendor.

- Cash flow alignment drives repeat purchases: Smaller businesses often face uneven revenue cycles. Flexible terms ensure that even during slow periods, buyers can keep purchasing what they need without draining their working capital.

For SMBs with no access to financing and no cash reserves, 33% say that quick payment access is the most important benefit when they make a purchase. - Personalization matters: Offering options like Pay in 4 for smaller orders and extended terms for larger ones gives customers the sense that payment solutions are designed around their actual needs.

-1.png?width=96&height=95&name=blog%20mockups%20(2)-1.png)

Over time, this flexibility creates a powerful loyalty loop. Buyers who feel financially supported are more likely to make repeat purchases, expand their relationship with the supplier, and recommend them to others.

Measuring the ROI of payment flexibility

Knowing that flexible payment options boost conversions and loyalty is a great start, but merchants need hard numbers to prove ROI. The good news is that the impact of financing can be tracked across multiple stages of the buyer journey.

Here are the most important metrics to measure:

Conversion rate at checkout

Track the percentage of buyers who complete a purchase when embedded financing is offered versus when it is not. Even small increases in conversion rates can translate into meaningful revenue gains at scale.

- Formula: ROI impact = (Conversion rate with financing – Conversion rate without financing) ÷ Conversion rate without financing × 100

- Example: If conversions rise from 18% to 25%, that’s a 39% uplift directly tied to financing.

Average order value (AOV) growth

Payment flexibility encourages customers to increase the size of their orders. A buyer may hesitate to place a $5,000 order upfront, but with terms like Pay in 4 or Net 30, that same order feels manageable. Compare AOV before and after offering financing to capture this lift.

- Formula: AOV growth = (AOV with financing – AOV without financing) ÷ AOV without financing × 100

- Example: If an average order grows from $1,200 to $2,400 when a buyer uses Credit Key, that’s a 100% increase in AOV.

Repeat purchase rate

Buyers who know they can pay on terms that match their cash flow are more likely to return. Track how often customers come back within 30, 60, or 90 days after their initial purchase.

- Formula: Repeat purchase rate = Number of financed customers who buy again ÷ Total financed customers

- Example: If 60% of customers who used financing place another order within three months, compared to 35% of customers who pay up front, that means financed buyers are almost twice as likely to return. This makes it clear that flexible payment solutions can directly strengthen customer loyalty.

Customer lifetime value (CLV)

CLV is one of the strongest indicators of long-term ROI. By increasing both order frequency and average spend, flexible financing can directly improve the total value each customer brings in over their relationship with your business.

- Formula: CLV = Average Order Value × Average Purchase Frequency × Average Customer Lifespan

- Example: Say you compare financed customers who purchase an average order of $2,000 five times a year for 3 years, with non-financed customers who purchase an average of $1,000 four times a year over 3 years — that’s a 2.5x lift in CLV.

($2,000 × 5 × 3 vs $1,000 × 4 × 3 = $30,000 vs $12,000)

Churn and retention rates

Financing builds trust and reliability. Compare retention rates among customers who use flexible payments against those who pay up front. A lower churn rate among financed users is a direct signal of ROI.

- Formula: Retention rate = (Customers at end of period – New customers acquired) ÷ Customers at start of period × 100

- Example: If financed customers retain at 85% compared to 65% for non-financed customers, it strongly suggests that financing is directly impacting recurring revenue.

New customer acquisition

Flexible financing can also act as a growth lever by attracting new buyers who might otherwise avoid a purchase due to cash flow constraints. Track how many new accounts are acquired as a direct result of offering flexible payment options.

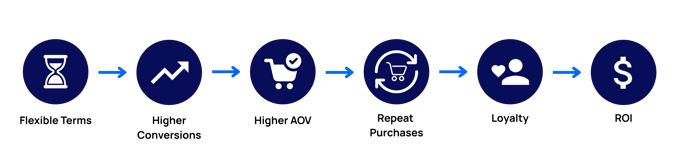

Together, these key metrics create a comprehensive ROI story:

- Conversions prove the short-term impact.

- AOV and repeat purchases show medium-term growth.

- CLV highlights the long-term payoff of embedding payment flexibility into the buyer experience.

In summary

Payment flexibility is now a core driver of B2B growth. When buyers are given more control over payment terms, merchants don’t only close more sales, they can enable larger orders, faster decisions, and deeper customer partnerships that extend well beyond the initial purchase.

The real advantage comes from measuring metrics over time. By quantifying the ROI of flexible financing across conversions, order size, and retention, you can turn these modern payment solutions into a solid growth strategy.

Topics from this blog: Featured