Consumer payments have undergone numerous changes over the past few years. It is no secret that the COVID health crisis has brought a series of drastic measures in the B2B payments sector. From the increase in the need to opt for contactless payment gateways to deploying Buy-Now-Pay-Later (BNPL) solutions; businesses have more payment options to choose from than ever before.

Although consumer payments have undergone numerous improvements over the past few years, the business-to-business platform is significantly slower in adopting new methods.

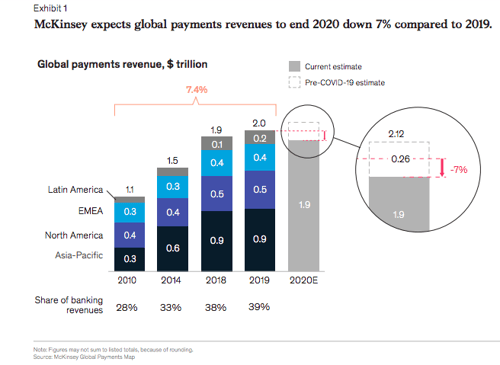

The 2020 McKinsey Global Payments Report, states that due to pandemic the global payments revenues were predicted to be down by 7% in 2020 when compared to 2019. Currently, close to 67% of all consumer payments use electronic payment options. On the other hand, 64% of the businesses still transact via check. Businesses still depend on payment methods older than two centuries in a world where instant transfers, digital disruption, and direct deposits have become the norm.

Source: The 2020 McKinsey Global Payments Report

To help business owners put up with the evolving B2B payment solutions, we have created this guide to help you understand all aspects of B2B transactions.

What Are Some of the Common B2B Practices?

Equipment Leasing

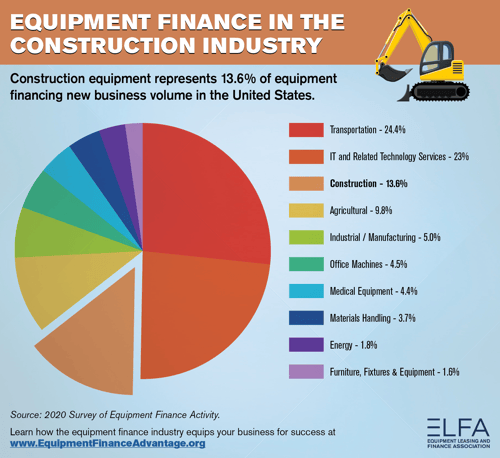

Purchasing business equipment comes with a significant upfront cost making it difficult for small businesses to get everything needed for efficient functioning upfront. Companies have access to all the required items by leasing business equipment while spreading out the expenses over a specific duration.

Business owners also reduce the risks associated with purchasing business equipment since you do not have to worry about maintenance and new versions of the same equipment coming out after a short time.

By leasing business equipment, business owners have access to a variety of benefits. The pain reduced monthly charges and spread out over several months or years instead of paying the entire amount in a lump sum. Missing equipment also comes with service add-ons or service agreements which provide peace of mind since you do not have to hire in-house technicians.

Source: https://www.elfaonline.org/data/data-home

Buy Now Pay Later

The Buy Now, Pay Later (BNPL) model is an alternate method of accessing credit and lending. It comes with various advantages, such as increased liquidity, cash flow, and speed. The process of applying for a BNPL is significantly less time consuming and intensive as a traditional loan or equipment financing. This makes it the preferred method of payment for businesses looking to buy immediate goods, especially online, that are larger than their typical day to day transactions.

With platforms such as Credit Key, businesses can benefit from flexible payment options by paying as little as 0% over the first 30 days or selecting up to 12 months terms right from check out.

For merchants that offer a Buy Now, Pay Later solution - they typically recognize an increase in conversion rate, order value, and order frequency. Merchants also mitigate fraudulent purchases and increase cash flow due to getting paid immediately on sales revenue.

Popular B2B Payments

B2B payments the first two transactions between two companies. They have other processes that make them more complex and differentiate them from person to person and business to customer transactions.

Types of B2B Payments

1. Credit Cards

Most B2B companies use credit cards to offer a convenient and affordable way to facilitate payments and float cash. Credit cards also provide an easy way of tracking transactions and sales revenue at the end of the month through paper or electronic statements.

Credit cards are subject to interest rates such as an annual percentage rate or APR when businesses make fast revolving balance payments, but it allows companies to access additional funds. They can benefit significantly if they treat credit cards like debit cards and pay off the balance every month. Credit card providers also offer one-time-use numbers to prevent cybercrime. After completing a transaction, the number becomes null and void, preventing fraud.

2. ACH Payments

ACH refers to Automated Clearing House. It represents another B2B digital payment method that is fast and more efficient than contemporary hard copy payment methods. With ACH transactions, funds move electronically from one business to another using bank accounts and a routing number. The ease of transaction makes ACH payments ideal for businesses.

Many organizations use ACH because it offers an affordable option. Some financial institutions promote ACH payments over traditional paper checks and even charge nothing to complete a transaction due to the minimal resources needed to receive funds in comparison to checks. ACH payments offer ease for tracking payments and appear on monthly statements. Businesses can also integrate them into their enterprise resource planning (ERP) system and other business applications.

However, ACH is only accessible in the United States. It also comes with a daily cut-off time for transactions.

Summary

The B2B industry keeps undergoing changes and improvements. Equipment leasing and the buy-now-pay-later model have moved the industry to new scales. B2B payment methods such as ACH payments and credit card payments have enhanced transactions between businesses.

Cash, wire transfer, checks are some of the widely used payment methods that continue to be in use by small and medium businesses. However, many businesses will soon have to adapt to new payment solutions like Credit Key which helps them drive growth.

Matthew Osborn

For the better half of a decade, Matthew has been submerged in the B2B Payments and Accounts Receivable as a Service space. As the Marketing Director of Credit Key, Matthew has an in-depth knowledge of sales and demand generation growth strategies.

View All ArticlesTopics from this blog: B2B Payments