The B2B business model for payment processing and payment options continuously evolves. The model is not the same yesterday as it is today, nor is it anywhere close to where it was a few years ago. The B2B businesses require adaptation and must follow in the footsteps of their B2C relatives. It all comes down to offering electronic, forward-looking payment options to simplify, automate, and streamline processing.

Understanding B2B Payments

Before we dive into the evolution of B2B payments, it is critical to get an understanding of what these payments mean. B2B or business to business are payment transactions between two merchants. A B2B payment is when you have one business selling a product or service directly to another business. With B2B payments, the business purchaser is the one making the payment to the seller.

There are two components to this equation when it comes to B2B payments. If you are selling your product or service, you need to recognize accounts receivable on that sale. When you receive the funding from the business in the form of payment, the accounts receivable entry clears. The business buying the product or service does the same practice, only with an accounts payable entry on their books.

The Difference Between B2C and B2B Payments

B2B payments may seem, at the surface, to be quite similar to B2C payments. There are stark differences to keep in mind though. The first and biggest difference typically comes in payment size. Business to consumer transactions traditionally has a payment size smaller in stature. Business-to-business transactions usually carry a higher dollar value.

Payment frequency and terms are two other comparable areas between B2B and B2C payments to call out. B2C payments are typically more frequent. It could be a daily transaction where a consumer goes to buy a coffee from their local coffee shop, for example. The terms are also noteworthy. Again, to the coffee example, that B2C transaction is not complex. A B2B transaction may carry specific and custom terms legal folks negotiate prior to execution.

B2C Payments Advancing and B2B Payments Catching Up

The interesting thing when it comes to B2C and B2B payments is that B2C payments always seem to be a step ahead. B2B payment trends continue to try and catch up in technology and advancements relative to where B2C payments go.

B2C payments continue to see evolution in the automation of accounts receivable and the recognition in that area, with home loan transactions, and more. The story usually goes that where B2C payments travel, B2B payments are not usually far behind.

1. The Movement in the Accounts Receivable Space

There continues to be growth and advancement in the accounts receivable space. Think about the way consumers used to buy things on credit. There would be purchases between a business and a consumer and a credit agreement would be put in place. The consumer would go back to the store, pay for the item over time until the transaction was complete. The whole scenario took a turn to modernization with the introduction of credit cards. With credit cards, business-to-consumer transactions became simpler. Consumers would have a credit limit and with their card, they would be able to set up accounts payable with the credit card company, while the company would satisfy the accounts receivable of the business making the sale. On average, credit cards are put to use for 23% of all payments, with debit cards taking up an additional 28%. That means over 50% of all business-to-consumer transactions happen on a plastic (or metal) card. source:

The business-to-business landscape is starting to the transaction into a similar arena. With businesses looking for more automation, there is a need for them to move away from traditional transactions where a purchase is made and a check goes in the mail. We are seeing business credit cards get put to use far more frequently than they were before, enabling these types of transactions much the same way we see them with consumers.

Businesses are also looking to various receivables automation software, where arrangements can be made to EFT funds from one business to another on set terms, recognizing the revenue and accounting for it in an adjustment to accounts receivable balances. This helps with the streaming of the entire sales process and puts it more in line with the B2C approach.

2. Ease of Making Big Purchases

B2C transactions that would carry a lot of complexity in the past would include things such as purchasing a home and acquiring a home loan. If you were in need of a loan to buy an automobile, or to get a line of credit, all of this would require a lengthy application process, document providing, etc. With B2C and the electronic evolution, you can now get an auto loan or even a home loan electronically.

There are companies that allow you to qualify for a mortgage through their smartphone application in as little as ten minutes. Loans that would carry long-term payment plans are now electronically accessible enabling these B2C transactions in a simpler fashion.

The B2B model is starting to go where B2C transactions have been for a while now. With the B2B model, we are seeing this mostly in the form of equipment financing. The majority of business models will have a need for equipment in order to provide their products or service. Equipment leasing or financing are the two new-age models that allow a company to get what’s necessary. According to a recent study, 79% of all companies in the United States put to use some form of financing when acquiring equipment. The forms of financing will sound very familiar to what we hit on with the B2C space earlier, as they were loans, leases, as well as lines of credit.

3. The Buy Now Pay Later Model is Exploding

The world took a hit when it comes to COVID-19, but what continues to emerge from it is new consumer trends in what and how they want to spend. B2C transactions saw massive growth in the BNPL or buy now pay later model of financing. This was seen from companies such as Klarna and Affirm that continue to push the boundaries of convenience for consumers in their purchasing habits.

The way the BNPL model works is that, at the time of purchase, consumers get a presentation of a convenient payment plan. According to a study by the Citizens Financial Group, 76% of consumers would be more likely to complete a purchase at retail if an easy and simple payment plan offering took place at the point of sale. When you go on Amazon and they offer you the ability to buy an Alexa and pay it off over five months at 0% interest for $20 a month, that is a BNPL model at work.

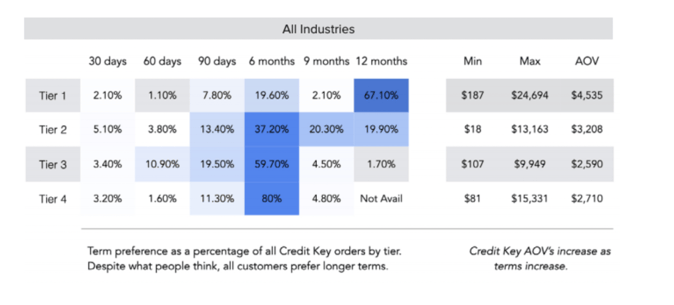

See above for typical terms selected and order sizes for Buy Now, Pay Later B2B purchases. Just like consumers want more flexible spending options, businesses are starting to look for the same. The B2B market is seeing the benefits of the BNPL model and wants to take advantage of the offering as well. If you were a business in need of equipment, and you could buy the necessary item with an offering of convenient payment terms at the point of sale, would that make the purchase easier? Of course, it would!

Market movers like Credit Key want to make it easy for businesses to tap into the potential of the BNPL model. They provide a business with an instant point-of-sale financing option. With this model, the seller or merchant gets payment in days, with buyers having the ability to extend payment terms out to 12 months. On top of that, the BNPL provider Credit Key assumes all risks of lack of collection.

Conclusion

The B2B market continues to follow the trends of where the B2C industry travels. We see this in the past with the growth of credit card usage, the move to electronic and instant approvals on things like auto loans, and now with the BNPL model growing exponentially. The trajectory is clear and it is critical to stay ahead of the game as a B2B merchant or buyer. You want convenience, terms that work for you, with no interest coming into play for the cost of the convenience. The future is what is up for grabs with offerings like Credit Key and it is a matter of you as a B2B merchant to grab on and see where it can take you next.