If we were to ask you what you think the top initiative for B2B ecommerce executives is, what would you say? Maybe you’d say things like, “Find a better platform,” or “Improve our digital marketing,” or even, “Increase our average order size.” But if you said these things, or anything along these lines, you’d be wrong.

In fact, the top priority for B2B ecommerce executives in 2018 is actually to offer “more flexible payment methods.”

“But wait,” you might say. “Can’t customers already pay with a credit card like they do in B2C e-commerce?” You might even say, “We’ve been using trade credit for decades. Can’t customers keep using that?”

Sure, they could. But really, they shouldn’t have to!

The truth is that in 2018, your business customers need access to more credit with better payment flexibility, and Net 30 trade credit or high-interest credit cards aren’t enough.

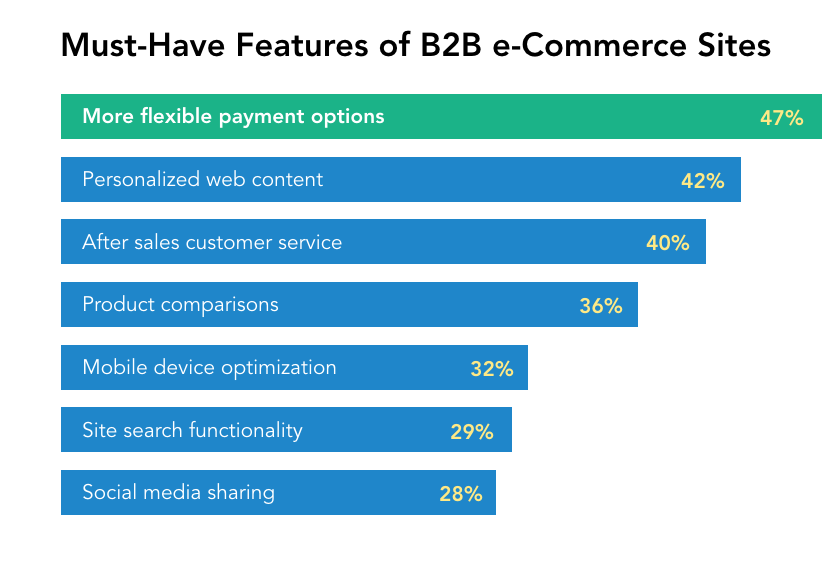

According to the 2016 Intershop E-Commerce Report, which surveyed 400 B2B decision-makers, found that the top need for B2B e-commerce systems is the ability to offer more flexible payment options.

Why is that?

Well, the truth is that trade credit process is cumbersome at best and not every B2B purchase can (or should) be bought with high-interest credit cards.

When credit cards aren’t seamless enough

Credit cards are great…when you need to reorder your office supply of staples and pens. What happens when you need to order $50,000 worth of new equipment? Chances are your business credit card limit won’t cover all of that. And even if it does, are your own sales terms going to get you enough cash to cover the cost without having to pay interest? Not likely. With the average interest rate on business cards at 13 percent, you’ll be paying nearly $4,000 in interest for this single order (depending on how fast you pay it off, of course). Doesn’t seem like that much in the grand scheme of things, but in businesses that have tight profit margins, $4k can be the difference between profit and loss on an order. Plus, you’ll possibly max out your credit line for that one order. If your credit card is the typical source for you to pay for raw materials, then you’ll never be able to purchase what you need to fulfill other orders.

Trade credit is broken

Let’s get real here: Trade credit is an outmoded, old-fashioned way of paying for B2B purchases.

Let’s say you’re company needs a specific widget to manufacture your product. One day, one of your customers puts in an order for your product that’s five times the size of their typical order. That’s great news, right?

Well, it also means you need to order five times the number of widgets, at possibly five times the cost. So, you go to your supplier’s nice little e-commerce website, put in what you want, and go to the check out, only to find that you don’t have enough credit on your credit card to pay for the entire order. To get what you want, you have to apply for trade credit directly with the supplier. And that’s a long, laborious, and painful process.

In order for most businesses to provide their customers with credit terms, the customer has to provide a lot of information to get approved. What’s more, they often have to fax/scan/email in pages and pages of forms, which then go to the credit team. There’s typically a 24-72 hour turnaround to get a response, mostly because the department handling these requests are often small and they work slowly. You have to call them to follow-up, and if they say no, you’re back to square one in terms of ordering what you need to fulfill this big order. Or they may approve only a limited amount of what you need, and it doesn’t cover everything you need. Or let’s say you’re fully approved, then you need to go back online and place your order again, possibly even going through an entire account creation process if it’s your first order with that supplier.

As you can see (and may have experienced), this process is ridiculously repetitive and time consuming. It’s not seamless, not simple, and frankly, it’s just plain stupid. Worst of all, it doesn’t put the customer’s needs first. In fact, it’s a sure fire way to lose a customer.

Sound familiar?

The cold, hard truth—and the awesome opportunity for B2B e-commerce

The truth is that how a customer pays for something is possibly the most critical piece of e-commerce. After all, it’s not a transaction without a payment. It’s the last mile, the last crucial step to take the customer over the finish line, and it can make the difference between securing a repeat customer and losing that customer forever.

But it also represents an awesome opportunity for B2B e-commerce sellers. There’s a huge opportunity for companies who offer more flexible payment options to grab market share, repeat customers, and even larger average order sizes. If you’d like to learn more about applying Credit Key’s flexible payment options for your business, contact us. We’re happy to demonstrate the ROI today’s best payment solutions can offer.