But only if your business adopts AP technology, according to a recent research report on the future of payments from Goldman Sachs. According to the report, an astonishing 60 percent of B2B purchases in the US are still paid with paper checks. This results in more than $2.7 trillion in administrative costs, 80 percent of which is incurred in small and medium-sized businesses (SMBs). Goldman Sachs estimates that the cost is equivalent to 2.2 percent of every invoice. This includes everything associated with processing paper checks—including banking fees, human resources costs, etc.

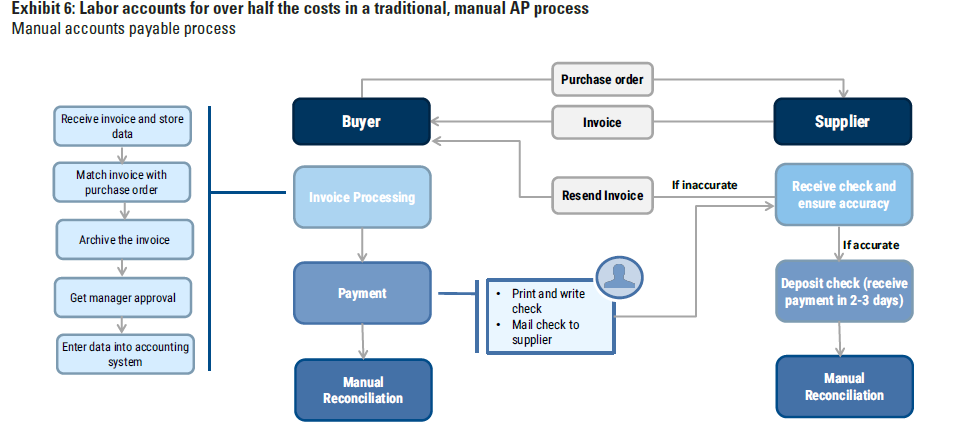

For anyone running an SMB, this figure should be mind blowing, especially considering that large businesses don’t incur these types of costs thanks to automation and scale. Processing checks is almost as long and arduous a process as trade credit. As you can see from the flow chart below, invoices paid by check require many, many steps, with several different people involved in the process and lots of room for human error.

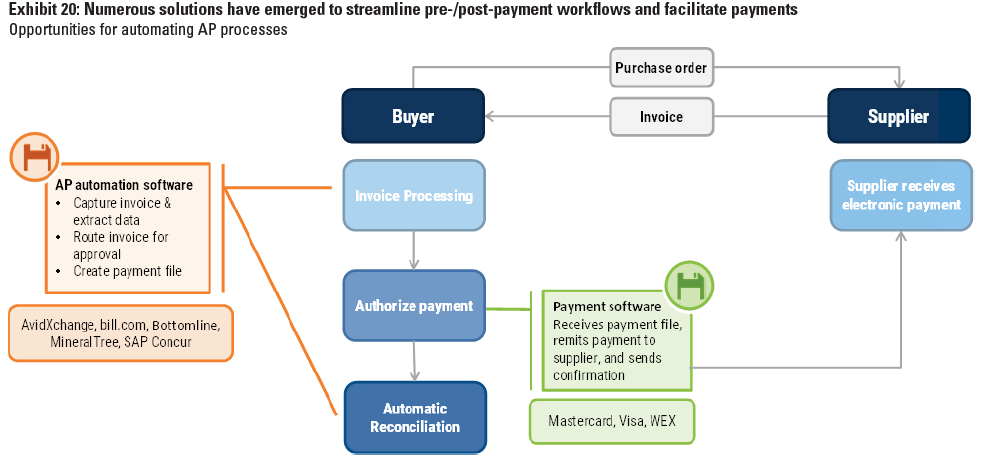

Compare that to the process when a firm introduces automation to the AP process:

Clearly, introducing automation saves a lot of steps in the process, and Goldman Sachs estimates that SMBs could actually cut their costs associated with payment processing by as much as 75 percent if they introduce automation.

Now some of this automation can occur through AP software, and some payments are made using credit cards. But for many SMBs, credit cards simply aren’t enough to cover regular B2B purchases needed to keep business running smoothly. Add in human resources still needed to chase up overdue invoices and you’re still looking at huge chunk of time needed for invoice processing.

To get around late-paying customers, some businesses turn to invoice factoring services, who basically provide businesses with a cash advance on outstanding invoices. But the fees here are significant; five percent of the invoice total on average.

Add up all these aspects of the current AP process for many B2B sellers and you can easily see that not only is processing checks or credit cards long and expensive, but they also can seriously constrict cash flow.

So where does Credit Key fit into all this? Quite simply: We’re cheaper and faster. By making payments electronic (and we’re including credit card payments in this), we’re making payments more efficient. The result is that Credit Key is less expensive for both sellers and buyers. Period. Our fees for sellers are comparable to the overall processing costs, but sellers also get their funds within 48 hours instead of 30 days (or in many cases longer). That means less time and resources spent on chasing overdue invoices, which in turns lowers the overall cost to process payments. And for buyers, our interest rates are far better than what they’ll get with a credit card.

The bottom line for most sellers is that they can improve nearly all aspects of the accounts payable process simply by offering flexible payment options. If you’d like to learn more about how your company can improve the AP process with a flexible payment solution, contact us. We’re happy to show you the impact Credit Key can have to your bottom line.