Say goodbye to the long, arduous process of getting your customers approved for terms

Digitize and streamline your application and approval process and deliver instant decisions by outsourcing your Net 30 program

Digitize and streamline your application and approval process and deliver instant decisions by outsourcing your Net 30 program

Approvals, underwriting, and risk management divert time and resources from your priorities. That’s where we come in.

You need a reliable cash flow to grow your business. But until now, you’ve had to wait weeks for customers to pay invoices. With Credit Key, you can offer Net 30 terms or Buy Now, Pay Later to your customers—and we’ll pay you within 48 hours. And with cash on hand after each sale, you can reinvest in inventory, sell to more customers, and scale your business more quickly.

Step 1

Customers fill out a simple, online application

Step 2

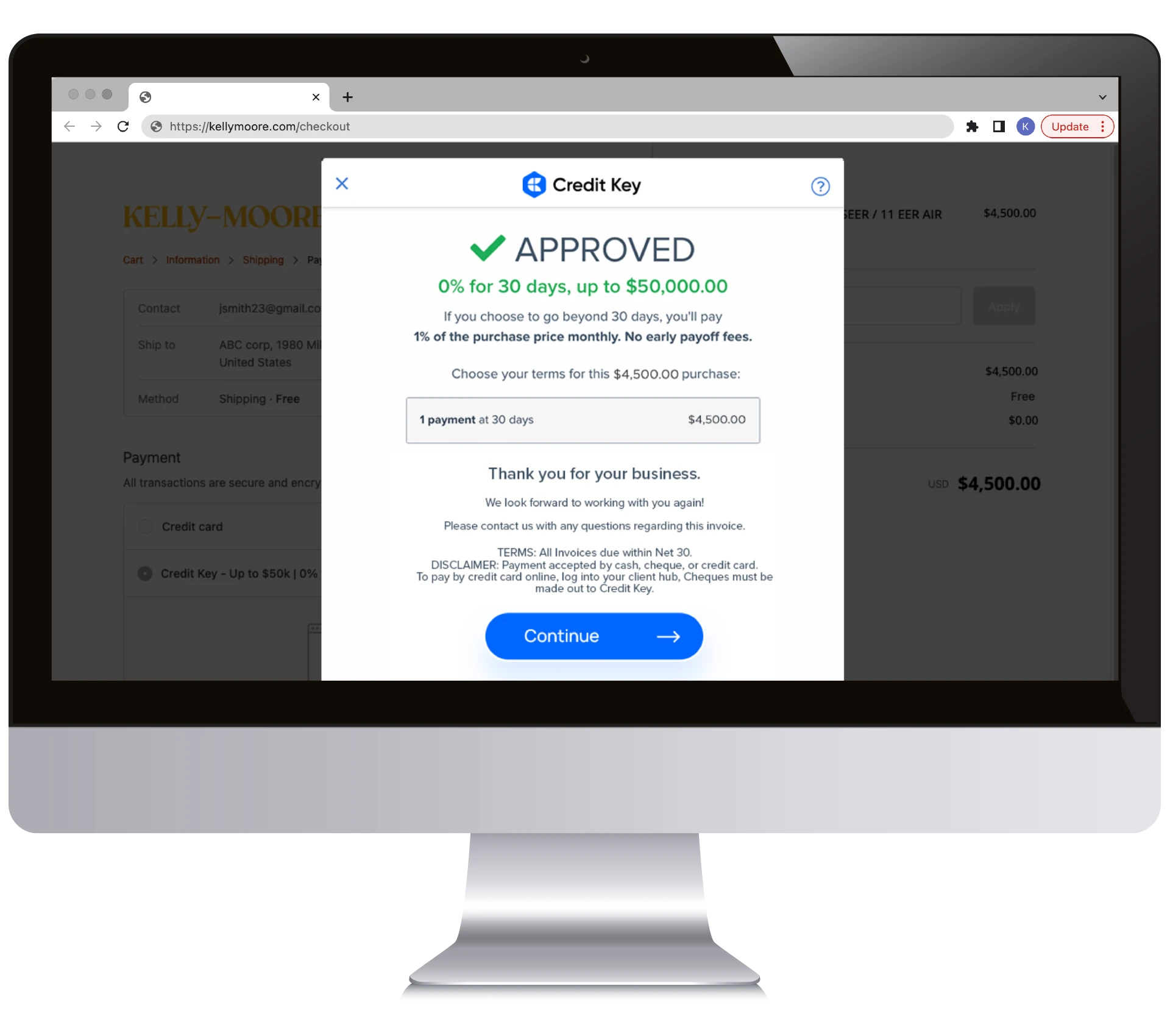

They receive an instant credit decision and can begin making purchases right away in their preferred channel: online, in-store, or over the phone

Step 3

You get paid within 48 hours while Credit Key handles all of the risk and collections

Trusted by 450+ leading merchants including...