We’ve talked considerably how Credit Key’s instant credit solution can help B2B merchants grow their business, reduce risk, and improve cash flow. But it turns out that the same benefits merchants can experience with Credit Key also be applied to distributors. After all, approximately 2/3rds of distributors already have an e-commerce presence, as compared to B2B manufacturers (for example) of whom only about 15 percent have used an e-commerce solution for more than five years.

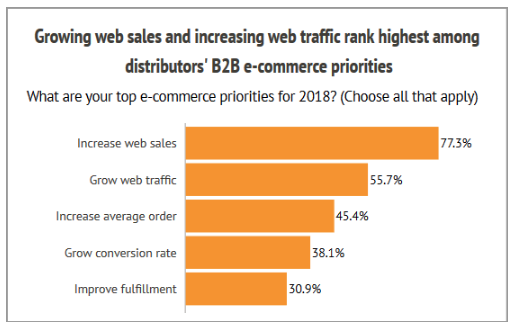

A survey from B2BecNews earlier this year revealed the top five e-commerce priorities for distributors:

Of these, Credit Key can help increase web sales, increase average order sizes, and grow conversion rates. Plus, Credit Key can help distributors get paid faster. Let’s take a look at each of these and how our instant credit solution checks these boxes for distributors.

Increase Web Sales

When a buyer places an order with a distributor and receives approval for an instant line of credit, that line can be used beyond just the single order. It can be used regularly with that merchant without the need for additional approval. If a buyer has to make choice between ordering from a distributor where they already have credit vs. a distributor where they need to re-apply for credit, which one do you think they’ll chose? Our experience with Credit Key clients is that the buyer will chose the company where they already have a line of credit, as it simplifies the entire purchasing process.

Increase Average Order Size

Similarly, when a B2B buyer has an existing line of credit with a distributor, they are more likely to place larger orders. For example, a buyer may usually spend $8,000 at a time with a merchant from whom they order regularly, possibly due to cash flow or budget constraints, sales volume, etc. But if they are extended a $10,000 line of credit, and they know they don’t have to pay back the line of credit for 30 or 60 days, they’re more likely to order more product at a single time, potentially saving them money and work in the long run.

Grow Conversion Rates

This particular feature goes back to reducing friction during the buying process. After more than two decades of B2C e-commerce, the consensus of e-commerce experts is that the fewer clicks, fields, and steps a buyer has to go through, the more likely they will be to complete a sale. The same holds true in B2B e-commerce. By offering instant credit approvals, a distributor can greatly decrease the amount of friction their customers experience in the checkout process, and thus will convert at a higher rate.

Get Paid Faster

Surprisingly, this isn’t something that distributors noted for their top e-commerce concerns, but it’s something that should be very near and dear to them. Because they’re simply buying and reselling products, distributors typically have narrower margins than typical merchants. That makes cash flow a regular concern for most distributors; it’s impossible to run a business where more cash goes out than comes in. But with Credit Key, that concern goes away entirely, as the distributor gets paid for all orders within 48 hours.

If you’re a distributor looking to get paid faster while growing your e-commerce business, contact us. We’ll show you exactly how Credit Key can make business easier to run.